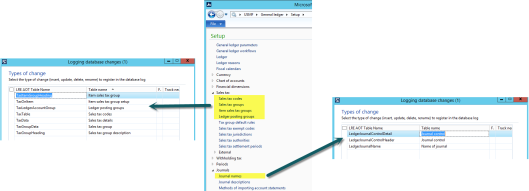

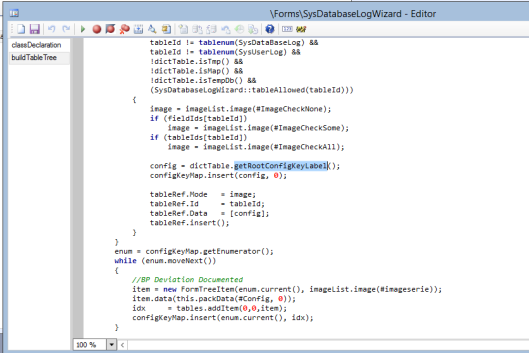

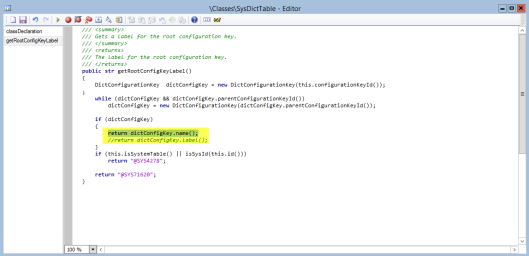

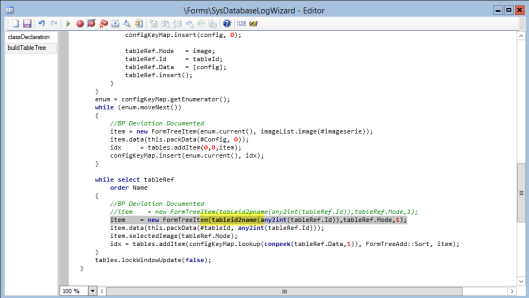

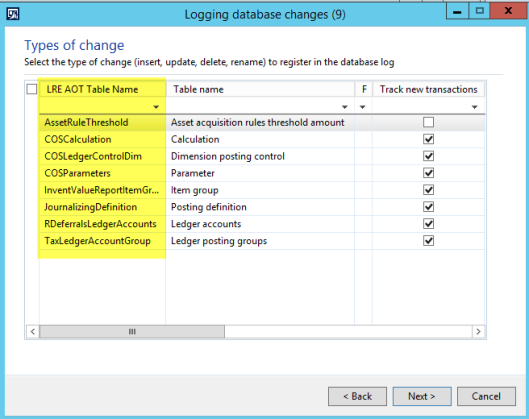

Against the background of the changes illustrated in the previous blog post, I logged the following tables/fields that are in my opinion the ones that should – from a financial perspective – be tracked at a minimum.

Fixed Assets

Setup section

Fixed Assets Value models

Value models Fixed asset identifiers (if used)

Fixed asset identifiers (if used)

Accounts Payable

Setup section Vendors

Vendors

Accounts Receivable

Setup section Customers

Customers

Cash and bank management

Setup section Bank accounts

Bank accounts

Please note that the previously illustrated tables that should get logged from a financial perspective represent my opinion. This selection is not meant to be exhaustive nor definite and aims to provide you with a starting point for setting up the database log.

Please also note that you should avoid logging transaction tables as logging them might have a negative effect on system performance.

If you miss important tables/fields that should be logged in any Dynamics AX setup and country-environment, feel free to leave a comment on this site to help other Dynamics AX users getting their setup right.