Over the last months I noticed many people asking how to budget on total accounts and how budget control needs to be setup for those accounts. Within this post I aim to answer this question by recording budget amounts on a total ledger account (e.g. for travel expense). Budget control should then verify whether the amounts recorded for all the individual ledger accounts that make up the total ledger account (e.g. the amounts posted for hotels, taxi, flights, etc.) exceed the total amount budgeted.

Let’s have a look at some business scenarios that illustrate how such budgeting scenarios can be implemented in Dynamics AX.

Scenario 1: Budgeting on total ledger accounts

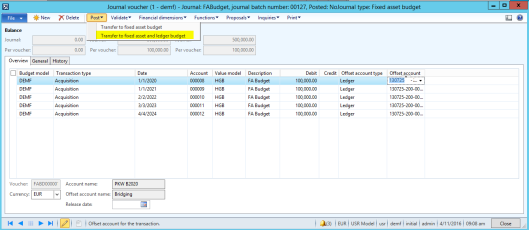

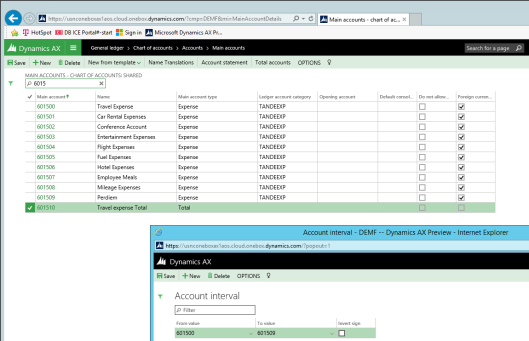

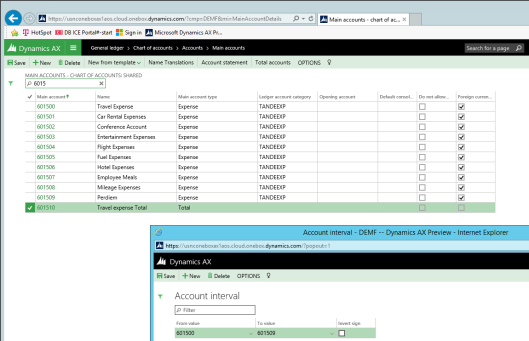

For the implementation of the first scenario a total account No. 601510 for travel expense is setup that comprises all other travel expense accounts No. 601500 to 601509. For details, please see the following screen-print.

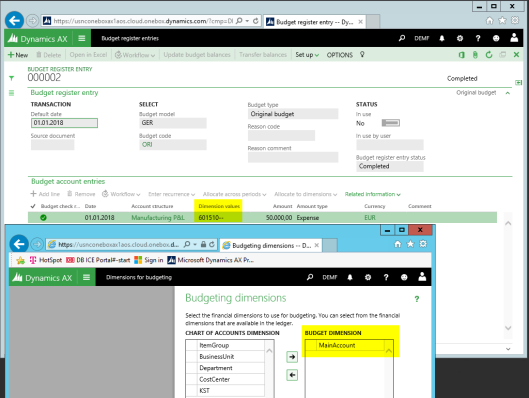

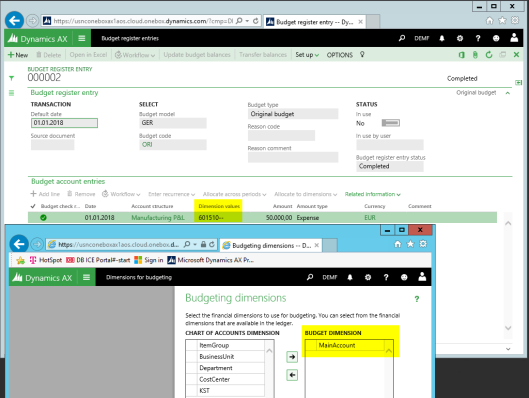

Thereafter, an amount of 50000 EUR is budgeted on the total account No. 601510 for the year 2018.

(Please note that I recorded the budget amount for this illustration at the main account level only. Further below, I will extend this scenario by budgeting on more than one single financial dimension)

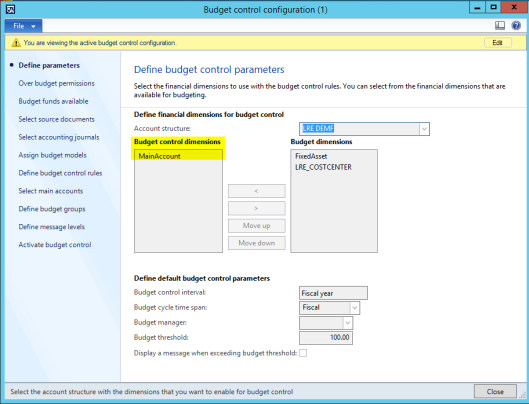

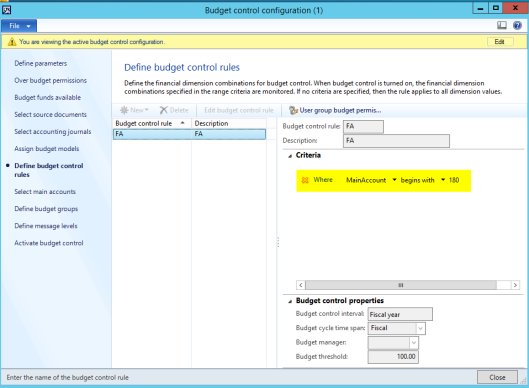

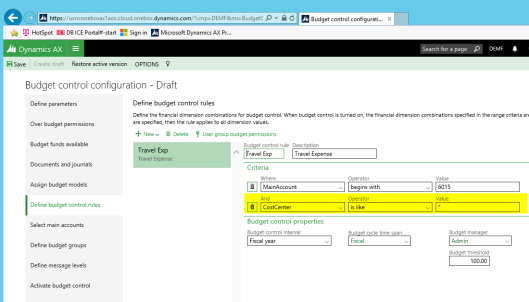

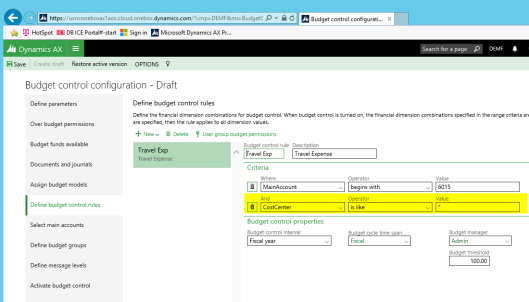

In order to let Dynamics AX check whether or not sufficient budget funds are available when recording travel expense related transactions, I setup the following budget control rule which specifies that all ledger accounts that start with 6015 are subject to budget control. (Please note that these are the travel expense accounts that I showed at the beginning of this post).

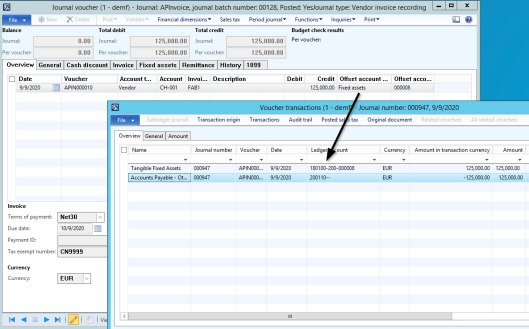

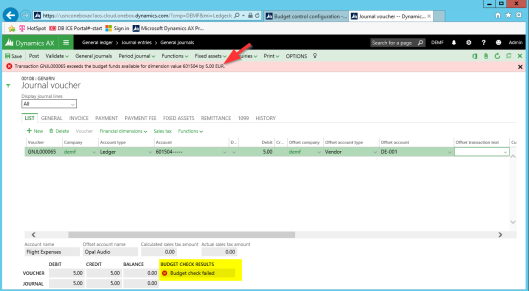

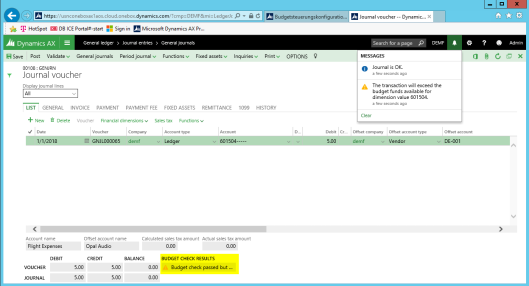

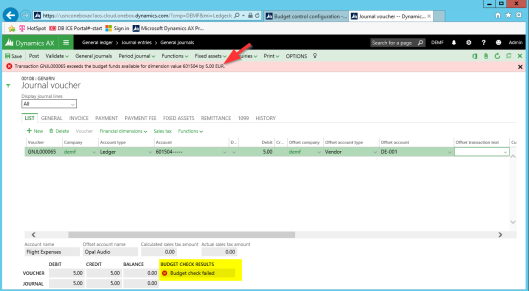

After setting up this budget control rule, I activated the budget control configuration and tried posting a transaction for 5 EUR on ledger account 601504, which belongs to the group of my travel expense accounts. Interestingly, Dynamics AX prevents me from recording this single transaction – see the next screen-print – even though the total amount recorded is far below the total amount budgeted.

The underlying reason for this system behavior is that no budget has been recorded for ledger account No. 601504 and that the only thing that has been specified in the budget control configuration is that all accounts that start with 6015 are subject to budget control.

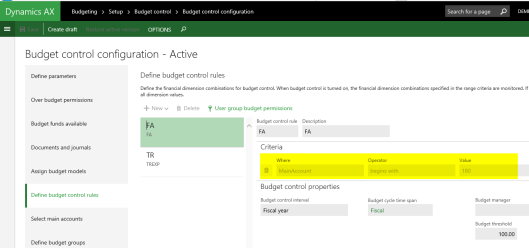

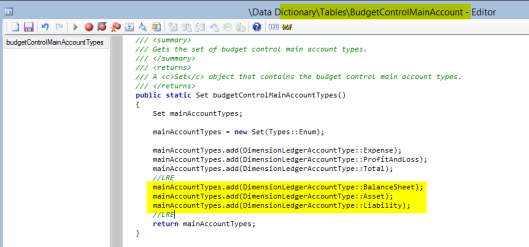

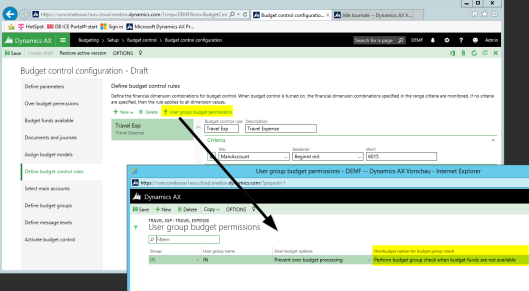

After this initial test I changed my budget control configuration as follows:

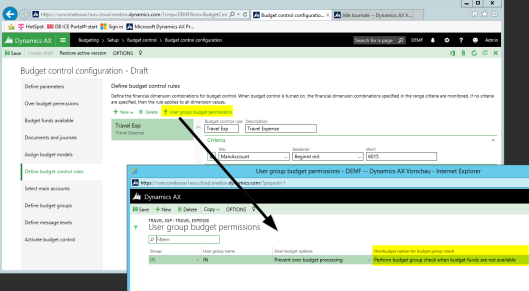

Change 1: I setup a user group (“IN”) that includes my Dynamics AX user and did not allow this user to process transactions that exceed the total amount budgeted. At the same time, I specified that Dynamics AX should execute a second budget control check at the budget group level if the first budget check (at the budget control rule level) fails.

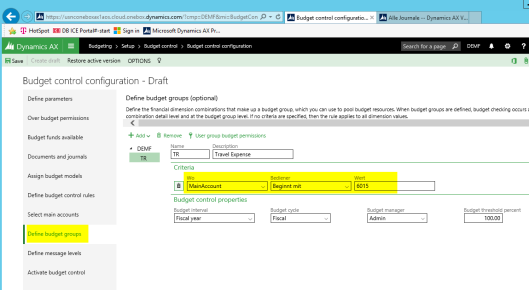

Change 2: The second change that I made in the budget control configuration was setting up a budget group (“TR”) that includes all my travel expense accounts including the total account (No. 601510) for which I recorded my budget.

This second setup change determines that Dynamics AX executes the secondary budget group check on the total amount that has been budgeted for all ledger accounts starting with 6015.

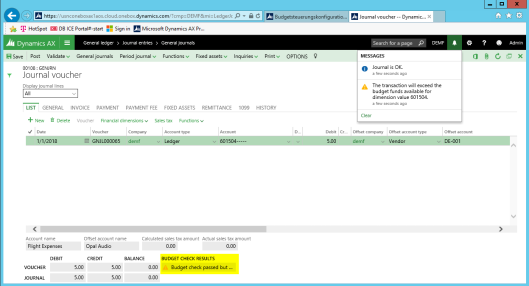

With this setup in place I tried posting the very same transaction for 5 EUR as illustrated before. The outcome of this second test is illustrated in the next screen-print.

As you can identify from the previous screen-print, Dynamics AX gives me a warning message which says that the amount recorded (5 EUR) exceeds the amount budgeted for the ledger account used (No. 601504). That is completely right, as no budget has been recorded for this account.

Yet, at the same time, Dynamics AX allows me posting the journal and says that the journal is ok. Now, this system behavior is caused by the setup of the budget group rule that checks the amount recorded (5 EUR) against the total amount budgeted for all travel expense accounts (50000 EUR) including the total account.

Scenario 2: Budgeting on total ledger accounts & financial dimensions (1)

The example used above for illustrating the first business scenario records budget amounts only at the ledger account level. Personally I felt that this example lacks a bit practical relevance as most companies typically budget on combinations of ledger accounts and financial dimensions such as cost centers, departments and alike.

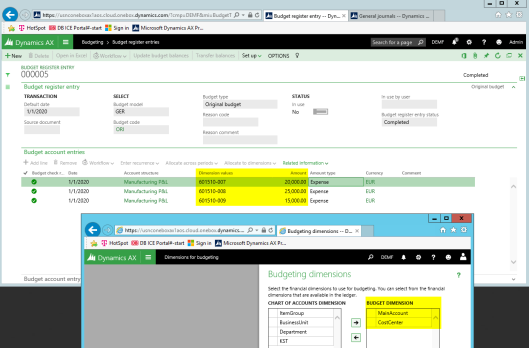

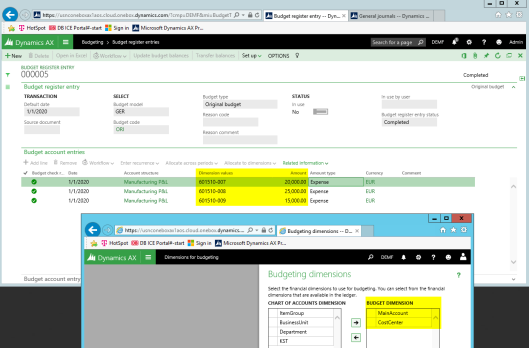

For that reason I extended my budget control scenario by budgeting at the main accounts and cost center level. The next screen-print shows you my second budgeting example that still records the budget on the total ledger account (No. 601510) but does now split up this total amount by cost centers.

Please note that the total amount budgeted is now 60000 EUR (20000 EUR + 25000 EUR + 15000 EUR).

As I do not only want to have my main accounts but also my financial dimensions checked for available budget funds, I included all cost centers in the budget control rule. (Please see the next screen-print).

This setup specifies that Dynamics AX shall check all my travel expense accounts and cost centers whether sufficient budget funds are available when recording transaction.

Please note that I have not changed the budget group setup. In other words, my budget control configuration is still setup in a way that a second budget control check is executed once the amounts recorded exceed the ones budgeted on the individual ledger account-cost center combinations.

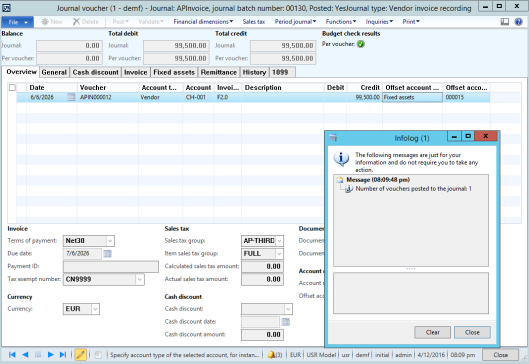

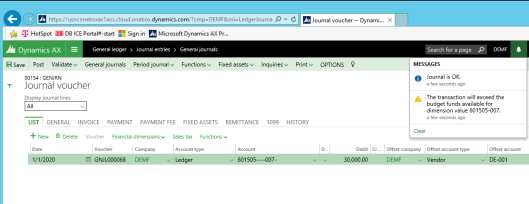

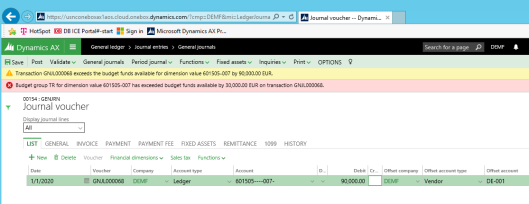

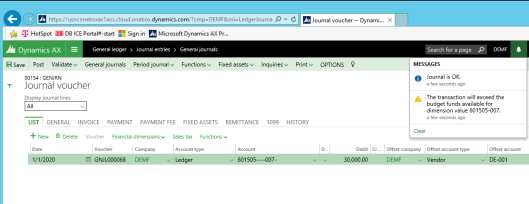

After making this modification in the budget control configuration I recorded a total amount of 30000 EUR for one of the travel expense accounts at cost center “007”. (Please note that only 25000 EUR have been budgeted for this cost center).

As the total amount recorded exceeds the amount budgeted for the cost center, Dynamics AX gives me a warning message but still allows me posting this journal. The underlying reason for this behavior is the budget group control setup, which compares the amount recorded (30000 EUR) to the total amount budgeted for all travel expense accounts that start with 6015 (60000 EUR).

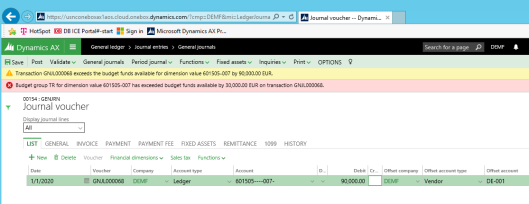

Now let’s have a look what happens if the amount recorded (90000 EUR) exceeds the total amount budgeted for all my travel expense accounts (60000 EUR).

As you can identify from the previous screen-print, Dynamics AX does now prevent me from posting this transaction as insufficient budget funds are available.

Scenario 3: Budgeting on total ledger accounts & financial dimensions (2)

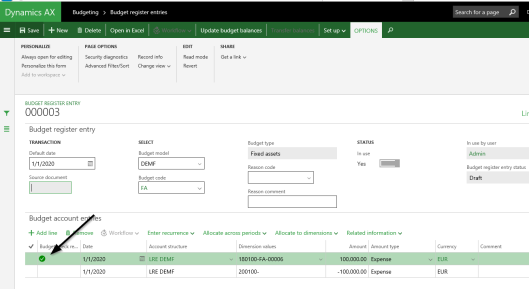

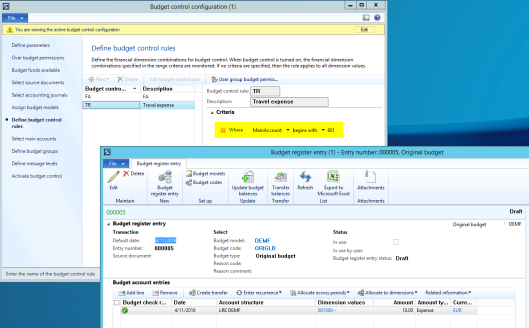

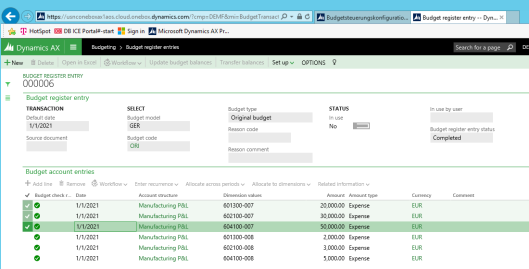

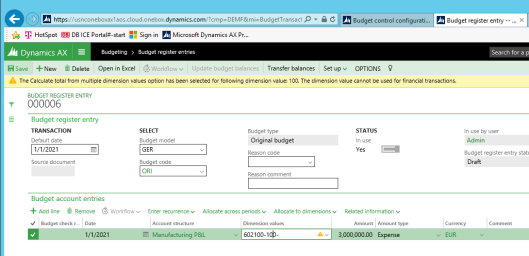

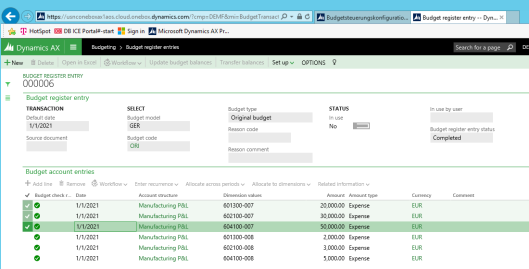

In this third scenario I changed my budget control setup once again to illustrate how budget control can be executed at the financial dimension level. For this illustration I recorded the following six budget register entries for my cost centers 007 and 008. Please see the next screen-print.

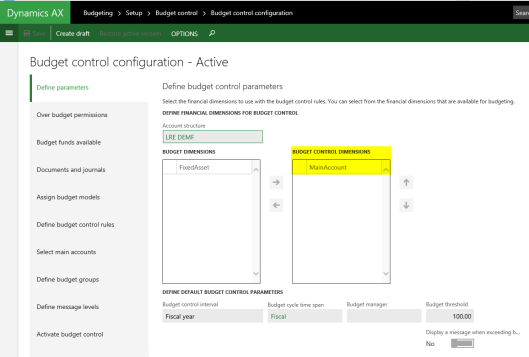

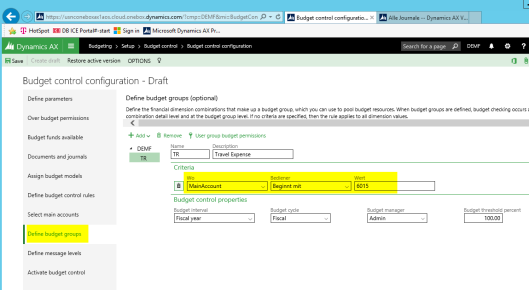

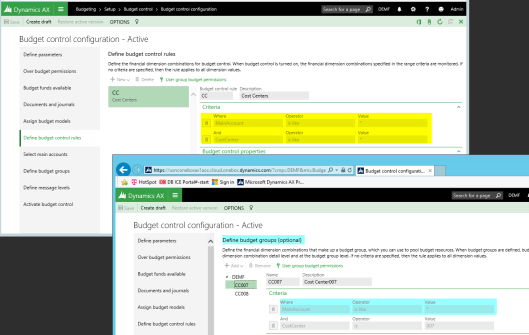

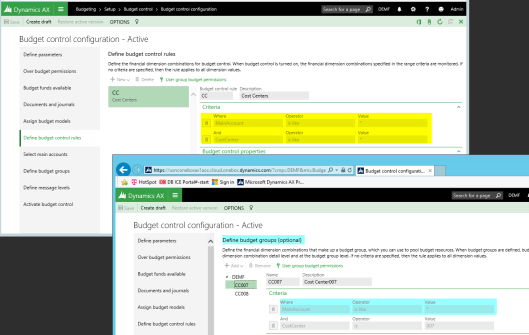

As before, I setup my budget control configuration in a way that all combinations of ledger accounts and financial dimensions are checked against the amounts budgeted (highlighted in yellow in the next screen-print).

In addition, a budget group rule was setup that allows recording transaction as long as the total amount recorded is less than the total amount budgeted for the financial dimension (highlighted in blue in the next screen-print).

Against the background of this setup, Dynamics AX allows recording transactions that exceed the amount budgeted for a specific ledger account-financial dimension combination.

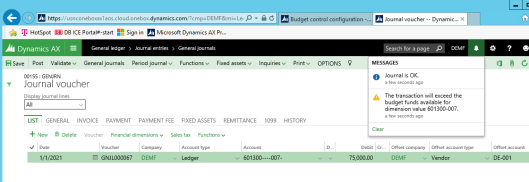

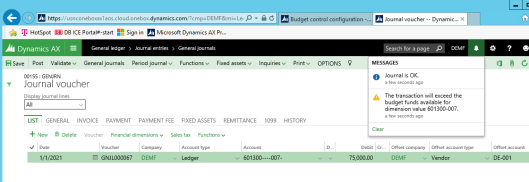

The next screen-print illustrates this behavior by showing that Dynamics AX allows recording a total amount of 75000 EUR even though this amount exceeds the one that has been budgeted for this ledger account-financial dimension combination (20000 EUR). That is because the budget group rule allows recording transactions up to the total amount budgeted for the financial dimension; in my example up to 100000 EUR.

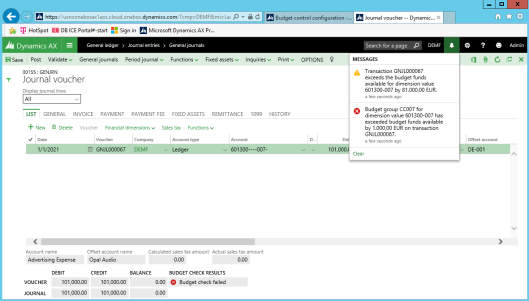

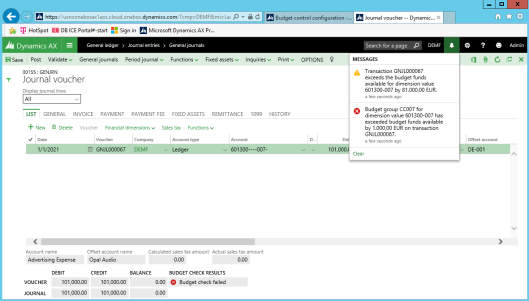

Once the transaction recorded exceeds the total amount budgeted for the financial dimension, Dynamics AX prevents me from processing this transaction. This behavior is illustrated in the next screen-print which shows that a transaction for a total amount of 101000 EUR cannot be recorded as the total amount budgeted for the cost center is less than the amount recorded.

Summary

Within this post I showed you some examples that illustrate how the budget control configuration can be setup to check transactions for sufficient budget funds available even though the budget funds have been recorded for different ledger account-financial dimension combinations.

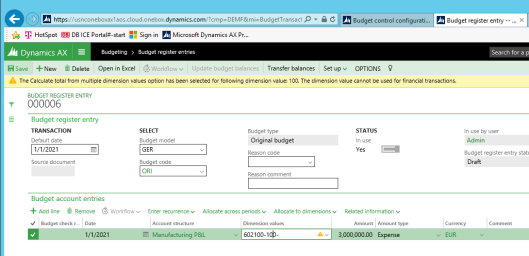

The last hint that I would like to provide here is the fact that Dynamics AX does currently support budgeting for total ledger accounts but not for total financial dimensions. If you try registering a budget for a total financial dimension – such as department 100 in my example illustrated in the next screen-print – Dynamics AX will prevent you from updating and completing this budget register entry.