Tags

Digitalisierung, Dynamics 365, Dynamics AX, F&O, International, Kaffee, Kakao, PowerApps, PowerBI, PowerPlatform, Vollers, Vollers Group

[German language podcast]

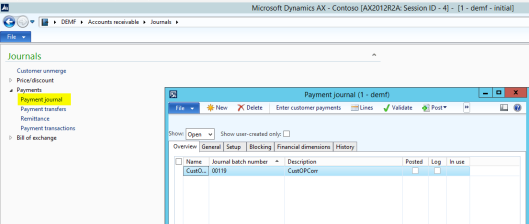

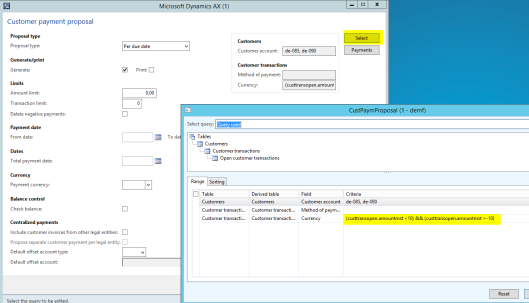

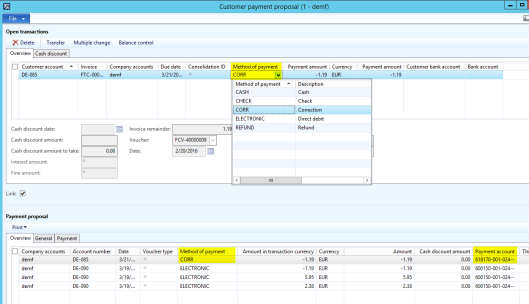

Willkommen zu unserem ersten Podcast im Jahr 2024. Heute sprechen wir mit John Hartholt, dem IT-Leiter von Vollers, einem Port- und Commodity-Service Provider, der sich auf Kaffee, Tee und Kakao spezialisiert hat. Vollers ist in acht Ländern mit 13 Standorten präsent und ist gerade dabei seine Prozess- und Wertschöpfungskette zu digitalisieren. Dafür nutzt das Unternehmen verschiedene Tools und Plattformen, wie zum Beispiel die Dynamics AX/F&O ERP Lösung und verschiedene Elemente der Power Platform. Wenn Sie mehr darüber erfahren wollen, wie man IT in einem internationalen Unternehmen erfolgreich implementiert und was es mit Kaffee, Tee und Kakao auf sich hat, dann hören Sie sich diesen Podcast an.