Tags

Controlling, Cost accounting module, Cost center accounting, Cost distribution policies, Management Accounting

This post focuses on cost distribution policies and how they differ from cost allocation policies. According to the D365 documentation, cost distribution and cost allocation policies differ in a way that cost distributions always occur at the level of the primary cost element of the original costs.

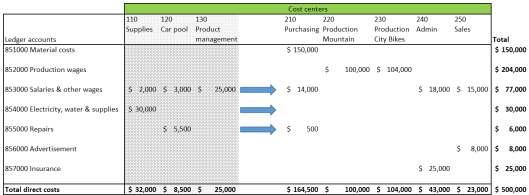

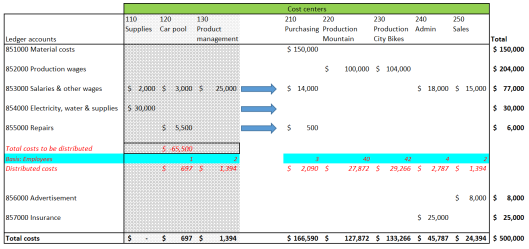

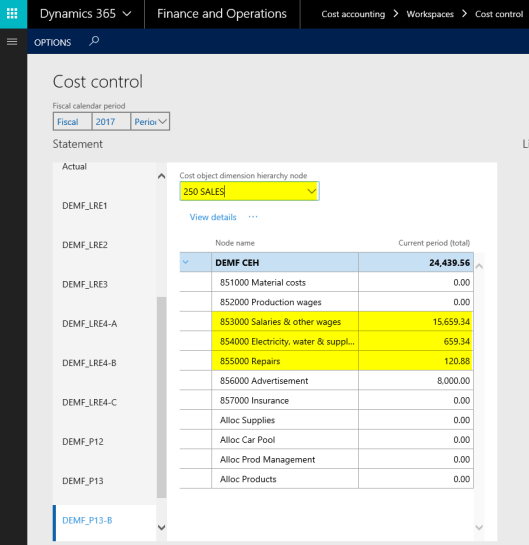

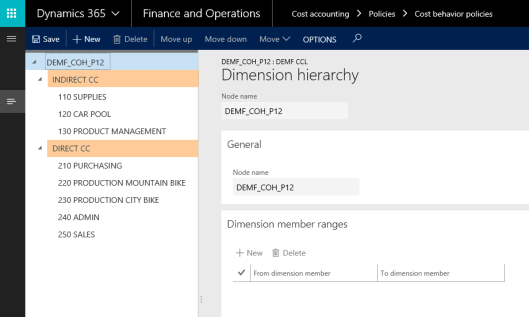

Applied to the previously used example, cost distribution policies should distribute the costs from the indirect cost centers to the direct ones, as indicated by the arrows shown in the next figure.

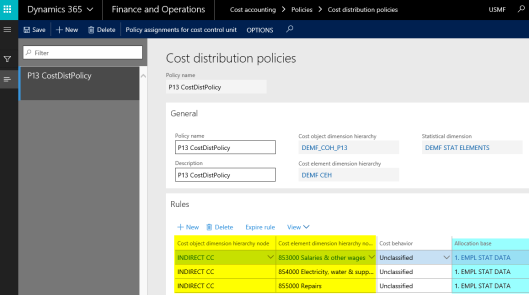

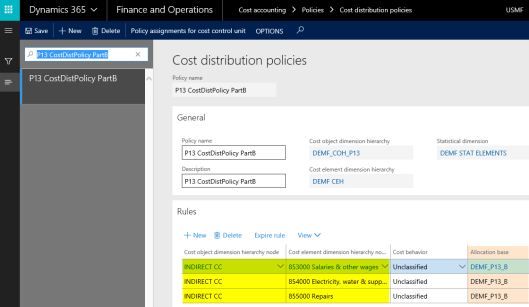

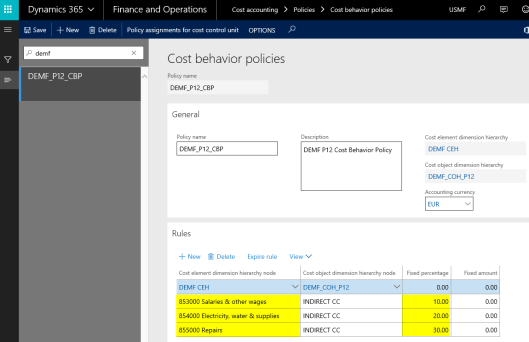

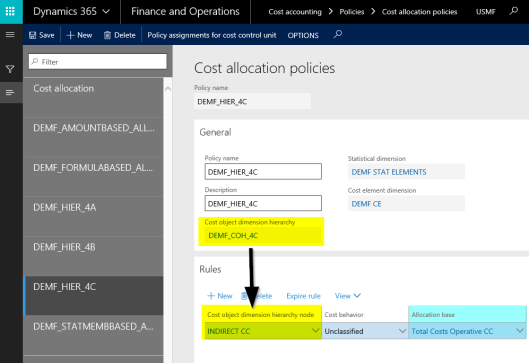

To verify this, the following cost distribution policy has been setup:

Please note from the previous screenprint that cost distribution policies also refer to a cost object dimension (‚INDIRECT CC’), as cost allocation policies do. Yet, different from cost allocation policies, a cost element node needs to be specified. The remaining cost behavior and allocation base columns are once again identical to what has been shown for cost allocation policies.

![]() The cost distribution policy used in this post makes once again use of the previously used employee related statistical allocation base.

The cost distribution policy used in this post makes once again use of the previously used employee related statistical allocation base.

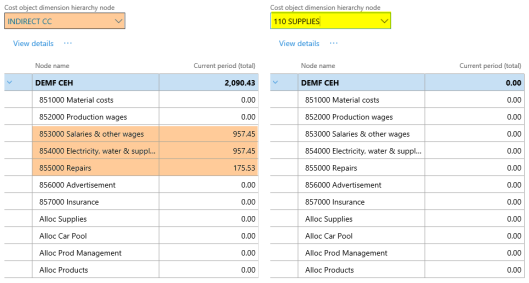

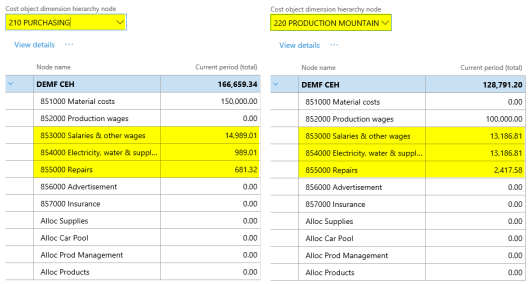

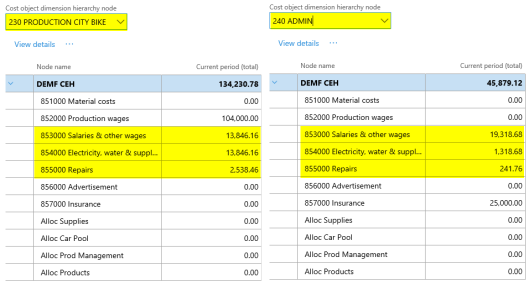

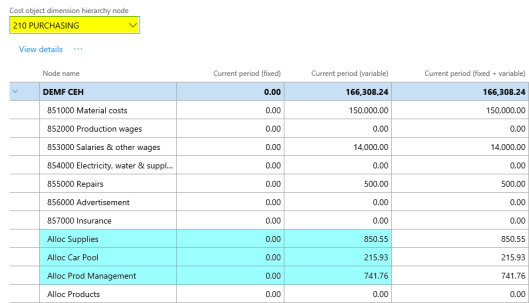

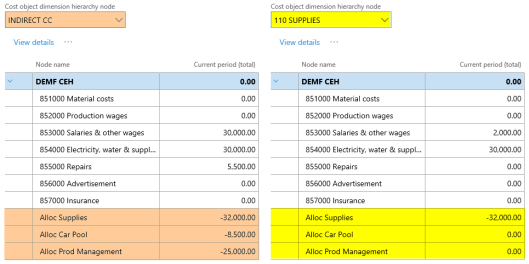

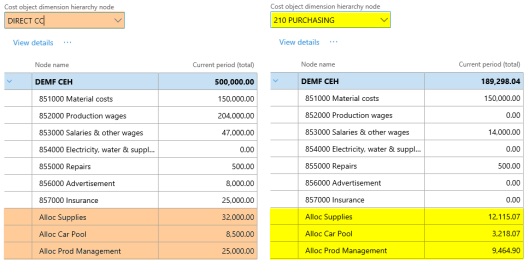

After setting up the cost accounting ledger and processing the data and the cost distribution policy, the following costs can be observed from the cost controlling workspace for the different indirect cost centers:

As one can identify from the prior screenprints, some costs remain at the indirect cost centers no. 120 and 130. The underlying reason for this outcome are cost distributions that are made within the group of the indirect cost centers. Those distributions are caused by the employee allocation basis used. The next graphical overview aims to illustrate the underlying issue.

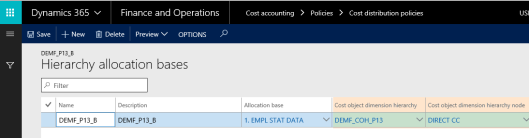

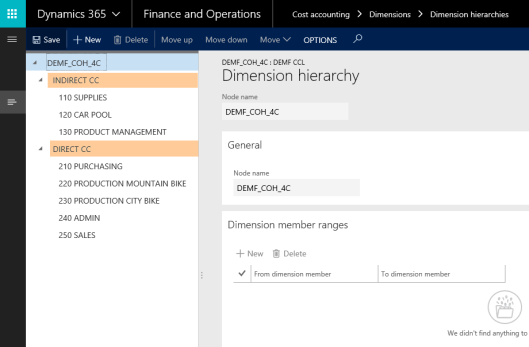

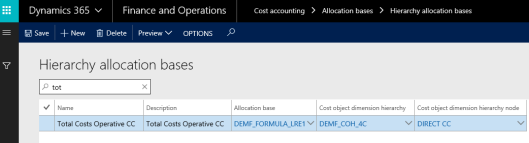

To avoid that costs remain at the indirect cost centers, the cost distribution policy is slightly modified in a way that a hierarchy allocation base (‚DEMF_P13_B’) is used.

![]() The major advantage of using a hierarchy allocation base is that one can specify to which cost objects cost distributions (or cost allocations) shall be made. In the example shown above, to the direct cost centers (‘DIRECT CC’) only.

The major advantage of using a hierarchy allocation base is that one can specify to which cost objects cost distributions (or cost allocations) shall be made. In the example shown above, to the direct cost centers (‘DIRECT CC’) only.

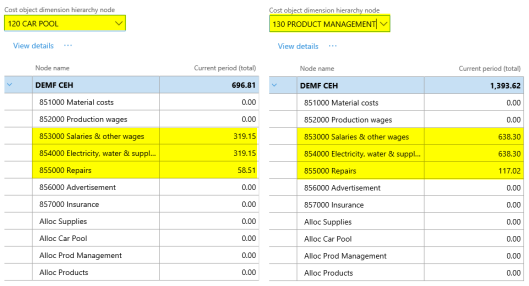

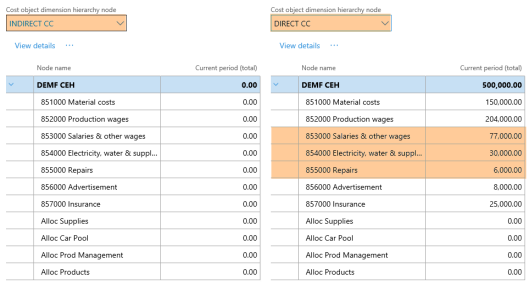

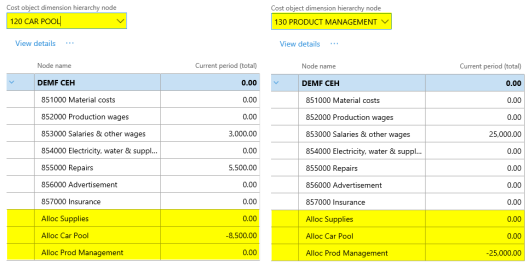

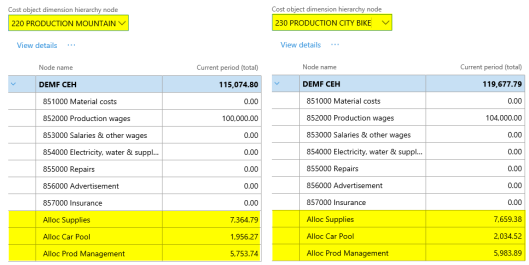

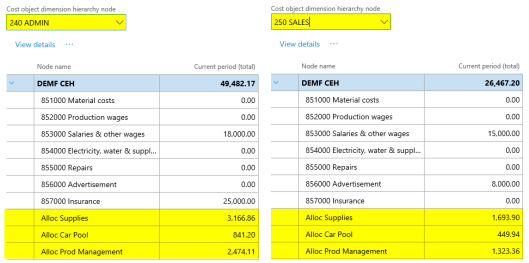

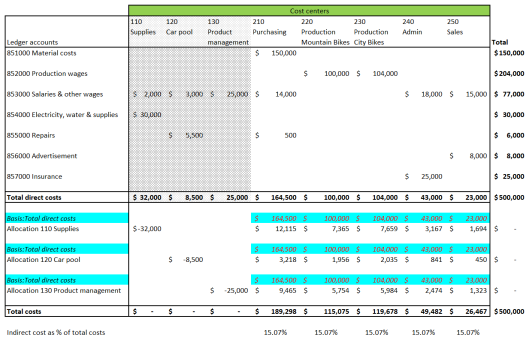

Reprocessing the cost distributions with the modified cost distribution policy finally results in the cost data shown in the next figures.

The next graphic has been prepared for a better overview of the cost distributions made.

Before ending this post, please note the following concluding remarks:

- The distributed costs won’t be shown as secondary costs even if a cost rollup policy is defined and assigned to the cost accounting ledger.

- The same outcome that has been shown above can be achieved by making use of a cost allocation policy that is not linked to a cost rollup policy.

The next post will introduce how to import statistical measure data from other D365 modules. Till then.