Tags

Controlling, Cost accounting module, Cost center accounting, Management Accounting, overhead rate policy, Statistical measure provider templates

The previous posts showed three different approaches how cost allocations in the cost accounting module can be made based on recorded project hour transactions. The approaches used

- project hour quantities that were imported into the cost accounting module for making cost allocations based on the recorded project hour quantities,

- project hour transaction vouchers that were generated by making use of the project module ledger integration, and

- overhead rate policies that allocated the costs to other cost centers based on project hour quantities recorded in the project module.

A major disadvantage of the first approach is that the complete cost center costs of the car pool cost center are allocated to the other operative cost centers irrespective of whether those costs are too high or low compared to an external market price.

The second and third approach did not completely allocate the car pool cost center costs but did not provide a benchmark of the required cost rate needed to allocate the complete cost center costs.

In this post, we will investigate how such a benchmark can be obtained by making use of the overhead rate policy feature, which is described on a step-by-step basis in the following.

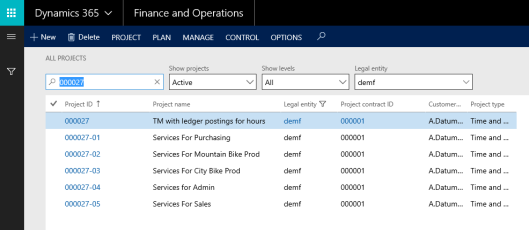

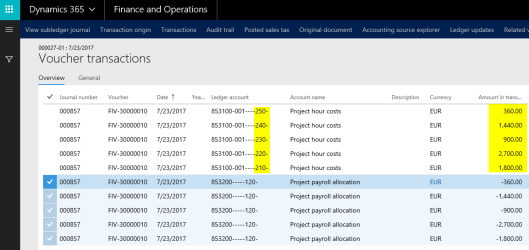

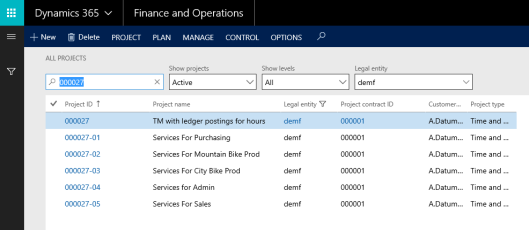

Step 1: Record hours in the project module

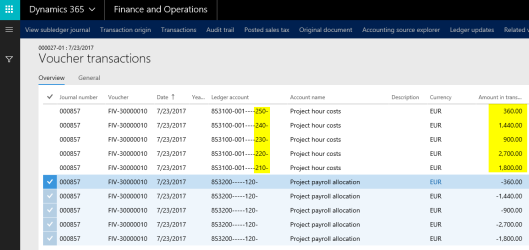

To get the cost allocation and overhead rate policy incorporated, hours are recorded in the project module first.

![]() Please note that no additional projects and postings have been created but that the transactions shown and recorded in the previous post have simply been reused. The next screenprints consequently document the previous postings and resulting costs only.

Please note that no additional projects and postings have been created but that the transactions shown and recorded in the previous post have simply been reused. The next screenprints consequently document the previous postings and resulting costs only.

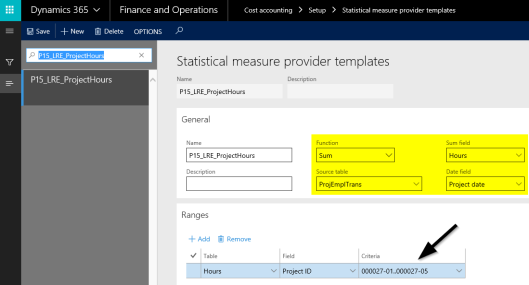

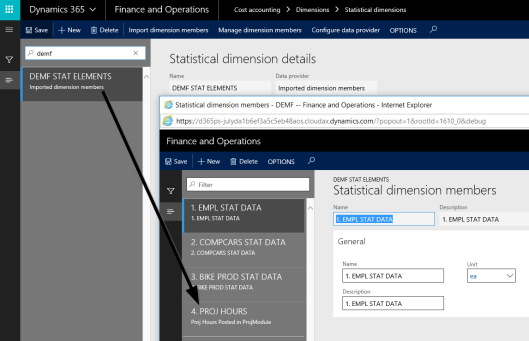

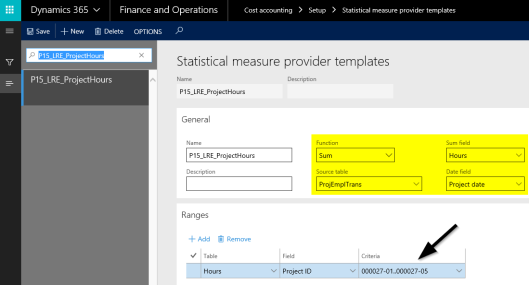

Step 2: Setup statistical measure provider template

Also the second and third setup steps are identical to what has been shown in the previous posts. Therefore, reference is made to what has been described there and the following screenprints are included for reasons of completeness only.

Step 3: Setup statistical dimension measure

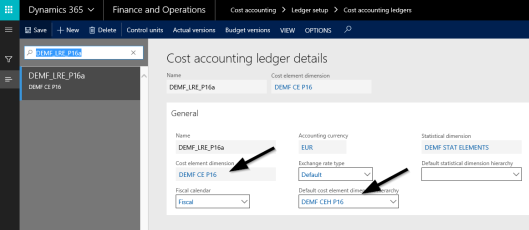

Step 4: Create cost accounting ledger

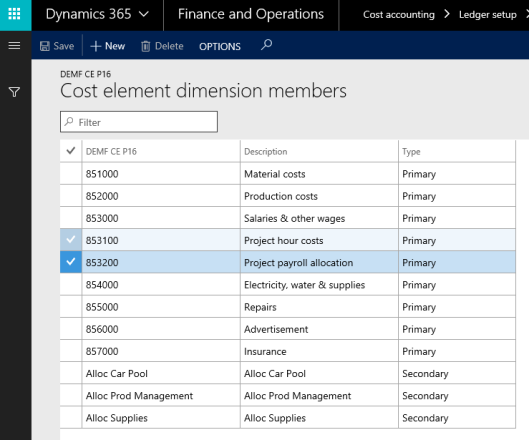

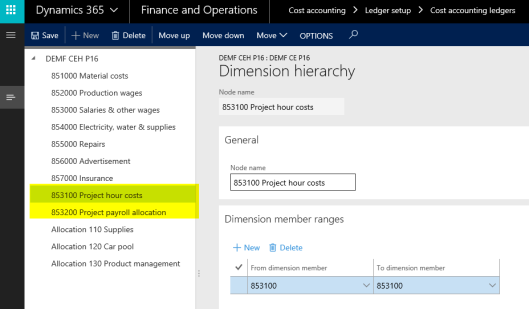

The set up of the cost accounting ledger slightly differs from the cost accounting ledgers that have been used before. That is because the project cost and payroll allocation accounts (853100 and 853200) have not been included in the cost element and dimension hierarchies used before. The next screenprints document the minor changes that have been made to the newly created cost element dimension (‘DEMF CE P16’) and the newly created cost element dimension hierarchy (‘DEMF CEH P16’).

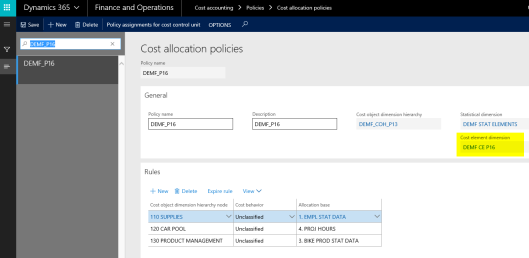

Step 5: Create cost allocation policy

The cost allocation policy that is used in this post is identical to the one that has been used in post no. 14 except that the newly set up cost element dimension (‘DEMF CE P16’) is used.

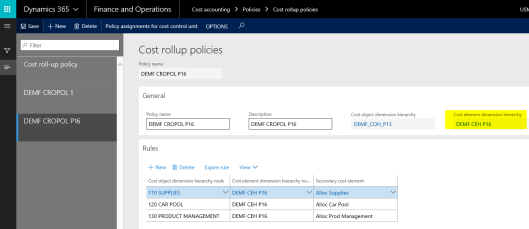

Step 6: Create cost rollup policy

Also the cost rollup policy is identical to the one used in post no. 14 except for the newly set up cost element dimension hierarchy.

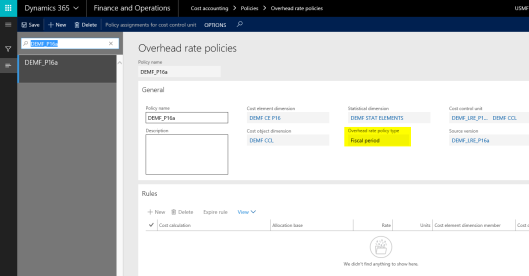

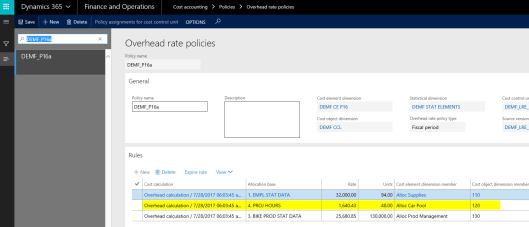

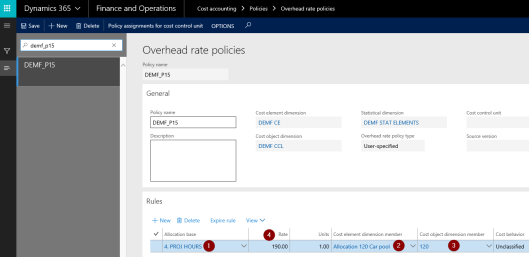

Step 7: Create overhead rate policy

The overhead rate policy used in this post differs from the one used previously in the overhead rate policy type (‘fiscal period’ vs. ‘user specified’). Because of the ‘fiscal period’ type selected, one cannot enter an overhead rate in the rule section, as D365 calculates the rates automatically.

Step 8: Process data in cost accounting ledger and configure workspace

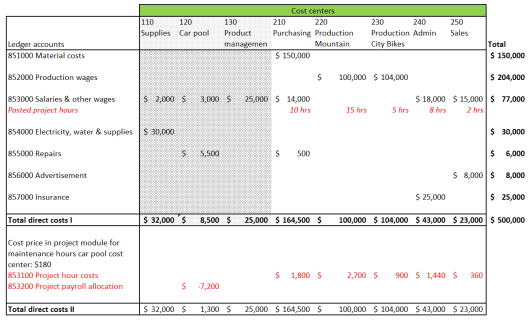

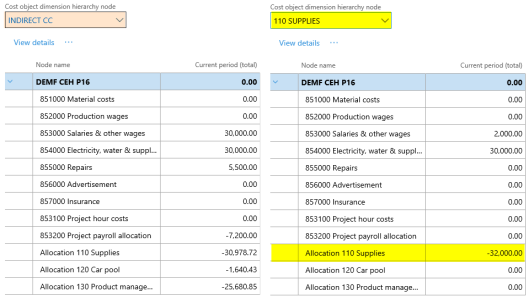

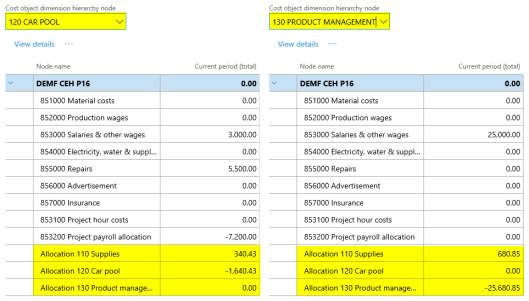

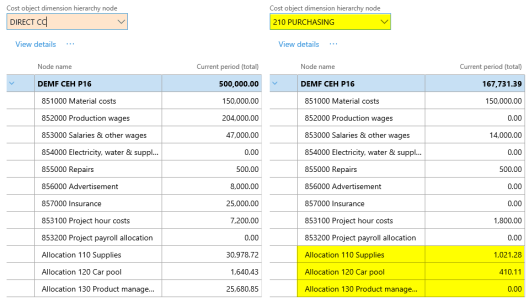

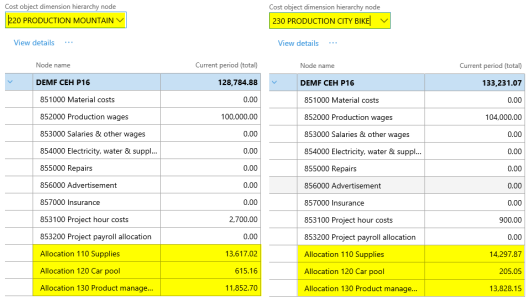

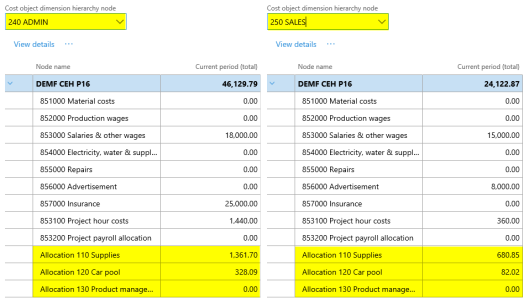

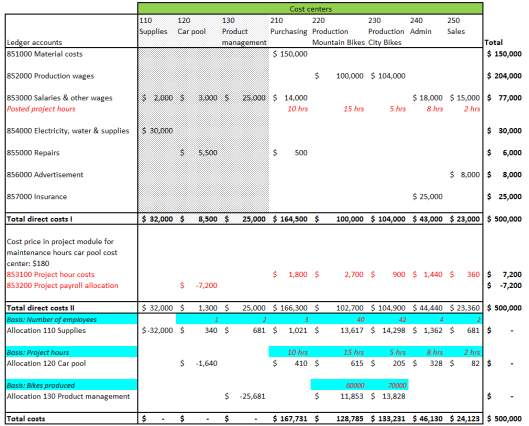

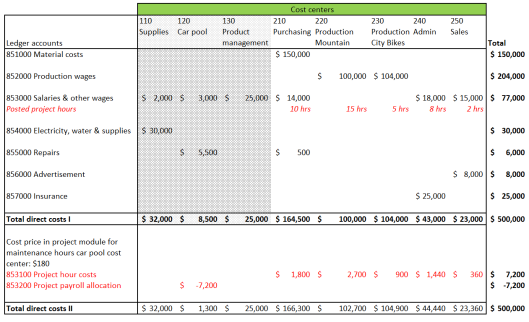

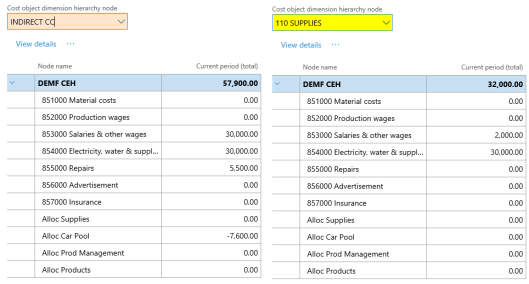

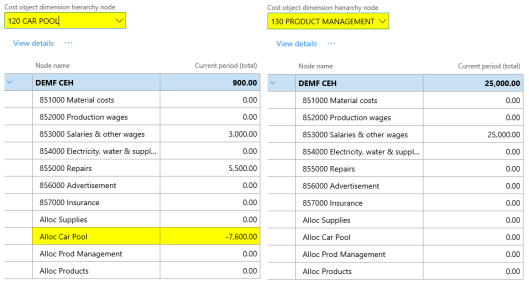

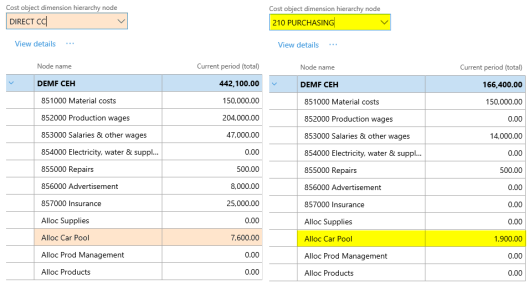

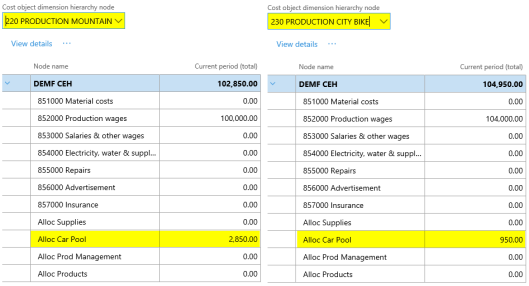

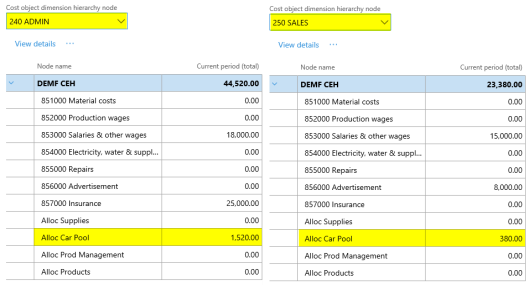

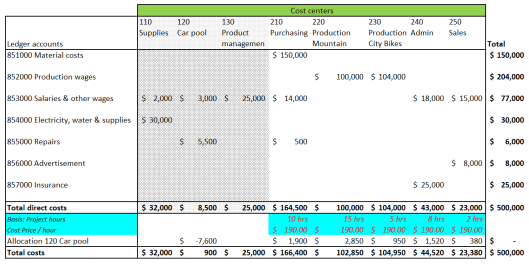

After processing the data and policies and after setting up a cost controlling workspace, the following costs can be identified for the various cost centers used:

The next overview summarizes the cost allocations made.

From the previous screenprint it can be identified that two allocations were made; one in the project module for the hours recorded with a cost price of $180/hour and a second one in the cost accounting module, where all remaining costs of the indirect cost centers no. 110-130 were allocated.

![]() Only the cost allocations made in the cost accounting module result in secondary cost transactions. The cost allocations made in the project module are considered to be primary costs from a cost accounting module perspective.

Only the cost allocations made in the cost accounting module result in secondary cost transactions. The cost allocations made in the project module are considered to be primary costs from a cost accounting module perspective.

After allocating all costs from the supporting or indirect cost centers no. 110-130 to the direct operative cost centers no. 210-250, the initially raised question on the benchmark cost rate for the car pool cost center has not been answered. An investigation of the overhead rate policy form – shown in the next figure – allows answering this question.

The overhead rate policy form shows a cost rate of $1640.43 for 40 units (hours) of work for the car pool cost center. Dividing the amount by the units results in a rate of $41.01 per hour. Because the cost accounting module allocated the remaining costs only that were not previously allocated through the postings in the project module, the $41.01 represent a cost rate difference. That is, in order to allocate the full costs of the car pool cost center, a rate of ($180 + $41.01 =) 221.01 is required.

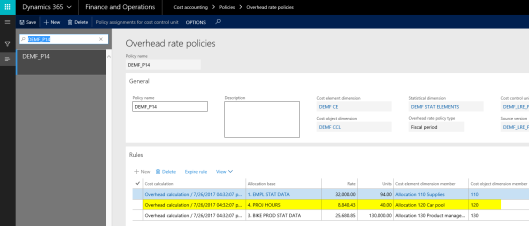

![]() If a ‘fiscal period’ overhead rate policy is applied to the cost accounting ledger that has been used in the previous post no. 14, the same rate can be identified. For details, please see the next screenprint.

If a ‘fiscal period’ overhead rate policy is applied to the cost accounting ledger that has been used in the previous post no. 14, the same rate can be identified. For details, please see the next screenprint.

In the next post, we will investigate how cost allocations that are made in D365 can be tracked and analyzed. Till then.