Tags

Controlling, Cost accounting module, Cost center accounting, Management Accounting, overhead rate policy, Statistical measure provider templates

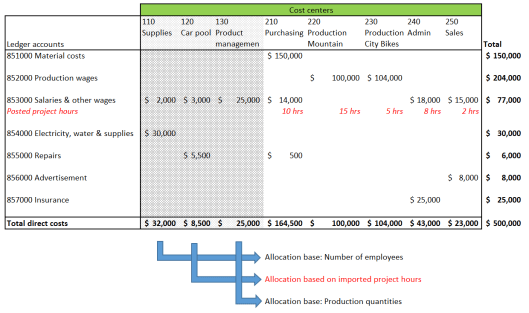

In the previous post, we had a look at how transactions that were recorded in the project module can be used as statistical measure for making cost allocations. This post will introduce two alternative options that illustrate how those allocations can be made.

Option 1: Project module

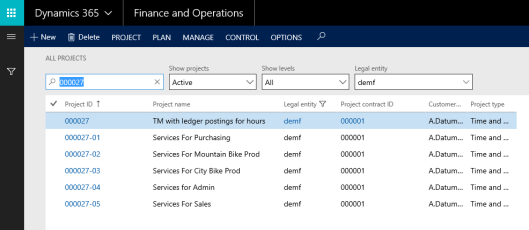

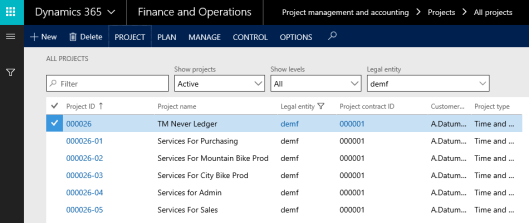

A first possibility how cost allocations between cost centers – based on recorded project hours – can be made is through project costing vouchers. Those vouchers can be realized by making use of a project group that has the ledger integration parameter for hour related postings activated. This is the case for the projects shown in the next screenprint.

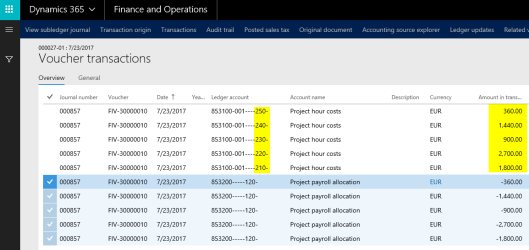

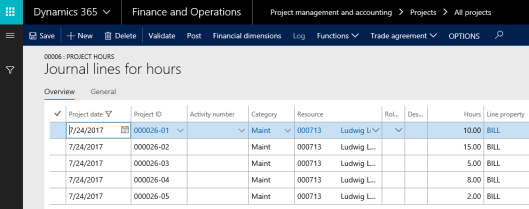

Posting the very same hour transactions for the car pool cost center manager that have been recorded in the previous post results in a voucher that is shown in the next screenprint.

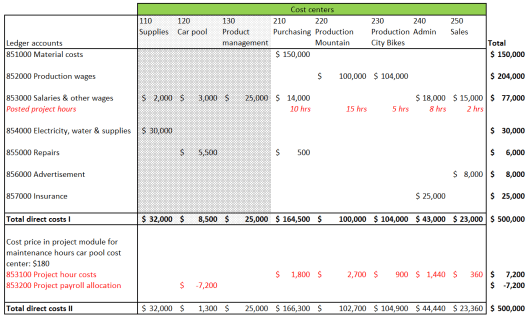

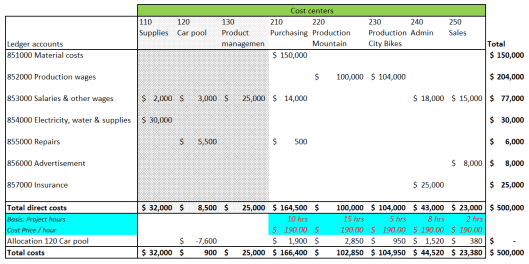

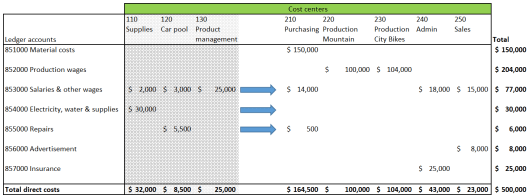

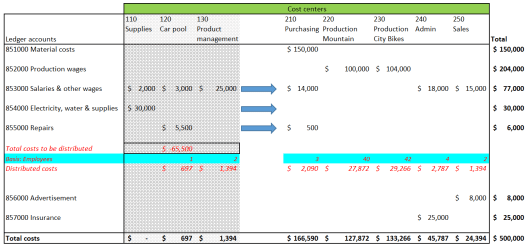

The voucher above shows that a project cost account (no. 853100) is – in combination with the operative cost centers – debited. The credit transaction is made on another profit and loss (P&L) account (no. 853200). As the debit and credit ledger accounts are both P&L accounts, no effect on company’s profit arises. However, because of the financial dimensions used, an allocation from the car pool cost center costs to the other direct cost centers occurs. This allocation effect is illustrated in the next figure.

- A cost price of $180/hour has been setup in the project module for recording the project hours of the car pool manager.

- From a cost accounting module perspective, the cost allocations made in the project module occur at the primary cost level. That is because the cost allocations are made outside of the cost accounting module

- The cost center financial dimension of the car pool manager that is credited is set up at the employee level in the Human Resource module.

From the previous screenprint, one can identify that some costs remain at the car pool cost center no. 120. Those remaining costs are a sign that the cost price of $180/hour is not sufficient to allocate all costs from the car pool cost center to the other operative cost centers. Provided that the $180 is a market rate (price), the costs remaining on cost center no. 120 can be taken as a sign that the internal management of the car pool is more expensive compared to an external (outsourced) management of that cost center services.

Option 2: Cost accounting module

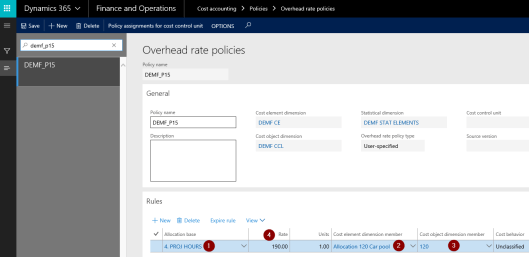

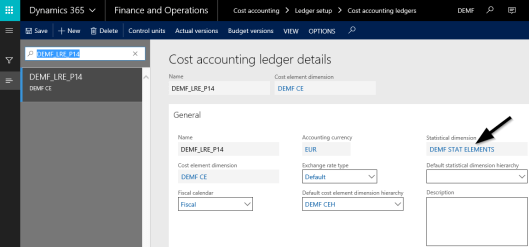

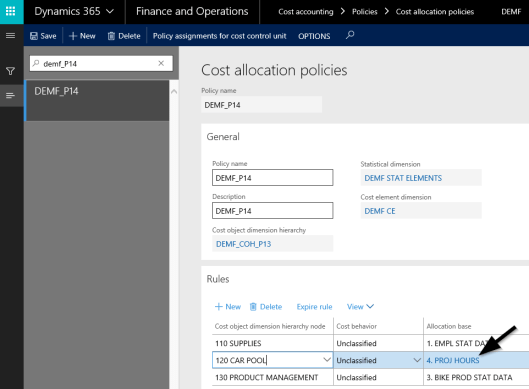

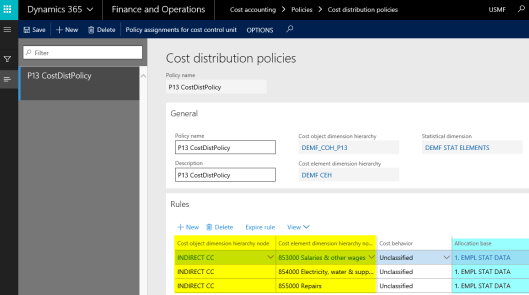

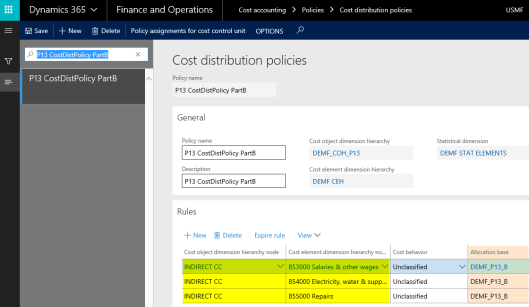

The second alternative for the cost allocation of the car pool cost center costs is the use of an overhead rate policy, which is exemplified in the next screenprint.

Making use of an overhead rate policy requires that a link to the statistical measure allocation base (‘4. PROJ HOURS’) is made (1). In addition, a secondary cost element that records the cost allocations (2) and the financial dimension to which the overhead rate is applied (3) need to be set up.

Most importantly, an overhead rate that is used for the creation of the cost allocations has to be determined (4). In the example shown above, a rate of $190 has been used to differentiate it from the cost rate that has been setup and used in the project module example shown before.

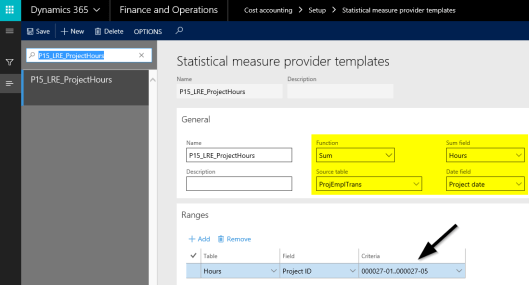

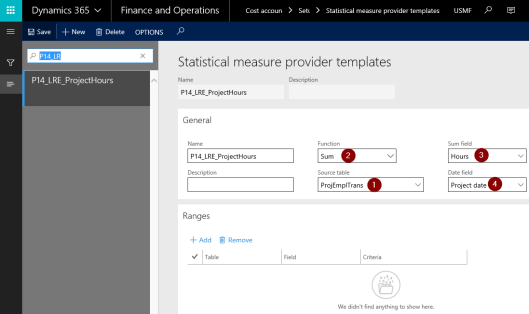

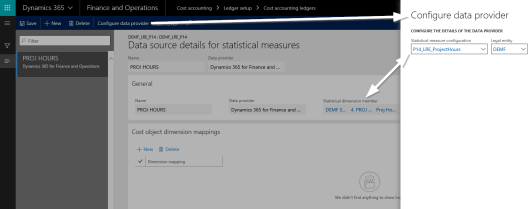

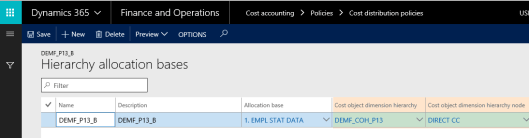

Similar to what has been shown in the previous post, a statistical measure provider template needs to be setup next for the transfer of the recorded project transactions (hours) to the cost accounting module.

![]() The only difference in the setup of the statistical measure provider template used in this post compared to the one used in the previous post is that a range for the newly set up projects has been specified. This is necessary because the hours of the cost center manager have – for illustrative purposes – been recorded twice; a first time at the projects ending with the number 26ff and a second time at the projects ending with the number 27ff.

The only difference in the setup of the statistical measure provider template used in this post compared to the one used in the previous post is that a range for the newly set up projects has been specified. This is necessary because the hours of the cost center manager have – for illustrative purposes – been recorded twice; a first time at the projects ending with the number 26ff and a second time at the projects ending with the number 27ff.

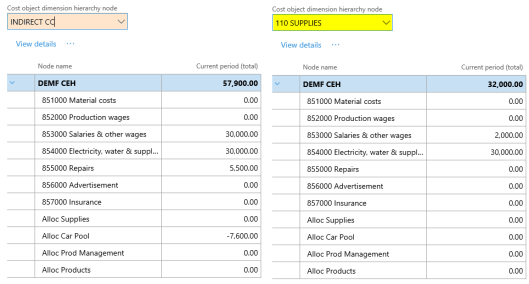

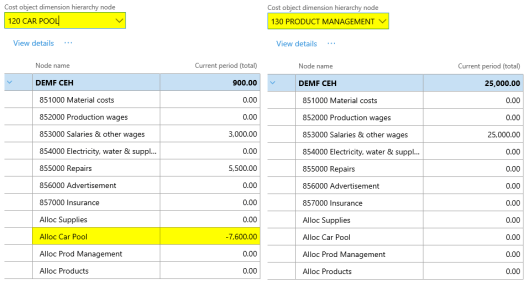

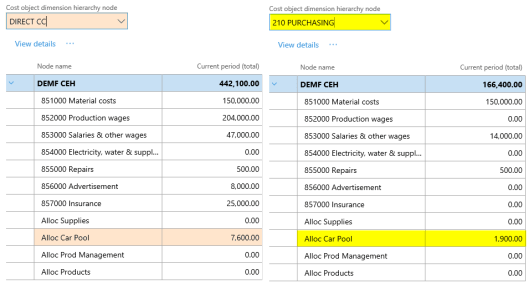

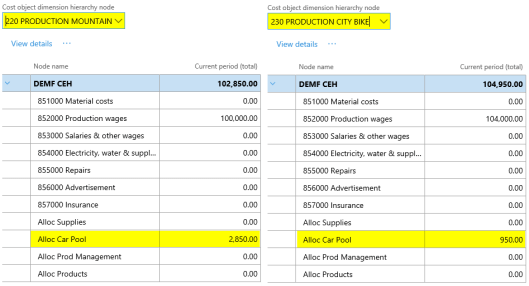

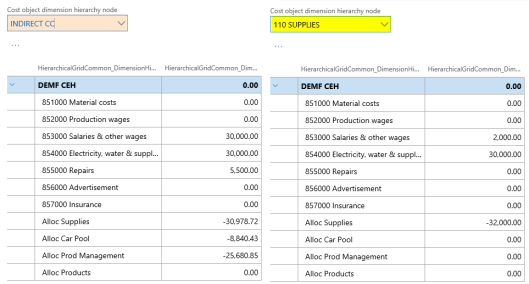

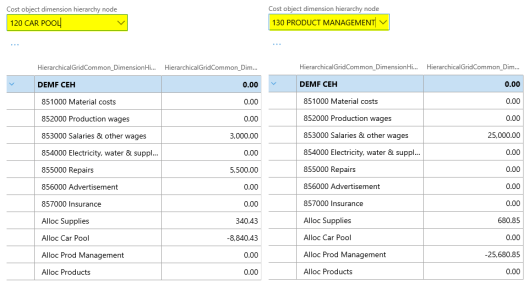

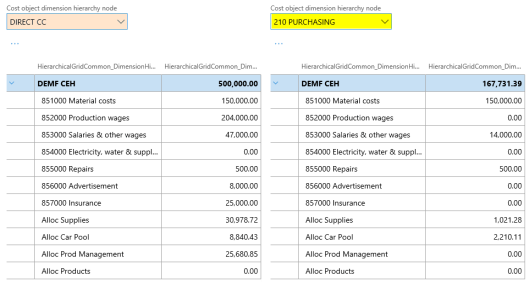

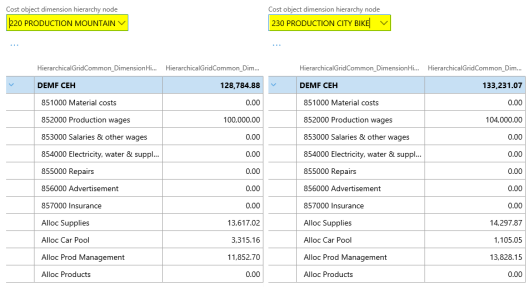

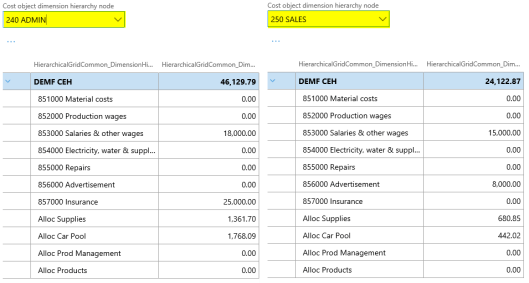

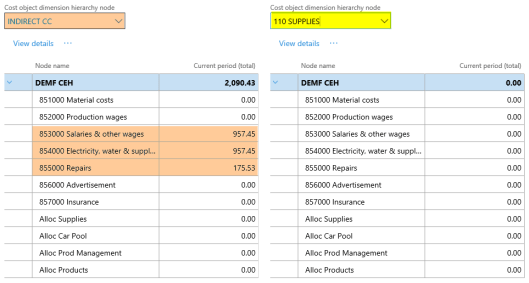

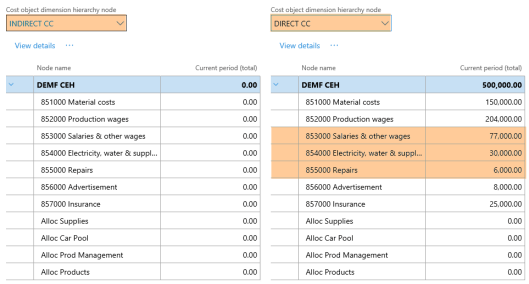

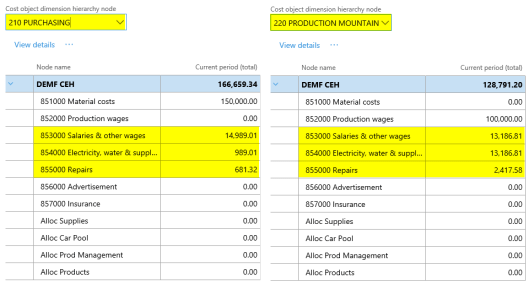

Processing the overhead rate policy through a cost accounting ledger results in the following costs for the different cost centers:

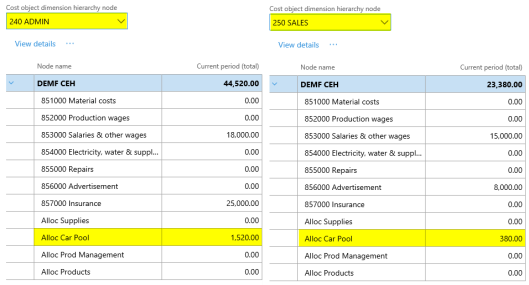

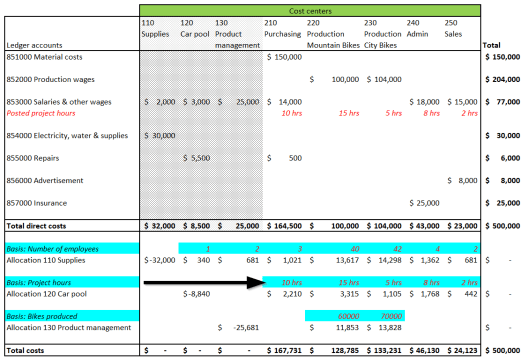

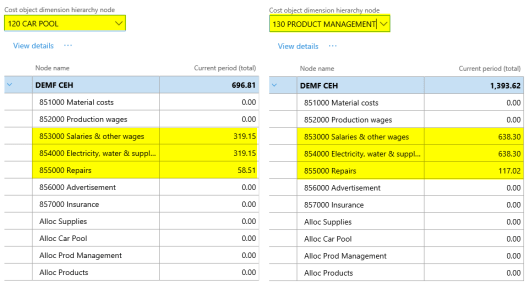

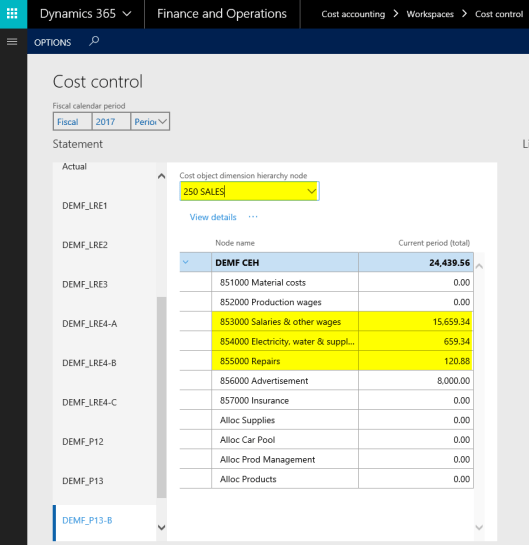

As shown in the previous posts, the next graphic summarizes the cost allocations made and the total costs that remain at the operative cost centers no. 210-250.

![]() Please note that a rate of $190 is not sufficient for allocating all costs of the car pool cost center to the other ones. This can be identified by the $900 that remain at the car pool cost center after the allocations are made.

Please note that a rate of $190 is not sufficient for allocating all costs of the car pool cost center to the other ones. This can be identified by the $900 that remain at the car pool cost center after the allocations are made.

In the next post, we will investigate an approach that makes use of cost allocations in the project module and an overhead rate policy in the cost accounting module. Till then.