Project related expense invoices can be recorded in a number of different forms and journals, such as the Accounts Payable (AP) invoice journal, the project expense journal or the AP invoice workbench, to mention only some. When it comes to expense invoice recording for projects, an important consideration is the time at which those expenses can be identified at the project level. The timing aspect is important especially in companies that face long invoice throughput times due to detailed invoice control and approval procedures.

To identify process related differences in expense invoice recording, an expense invoice for $150 will be recorded next through a standard AP invoice journal. This process will then be compared with entering a similar invoice through the so-called invoice workbench.

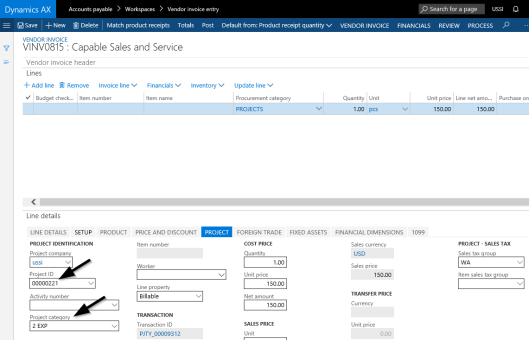

Let’s get started with the process of recording an expense invoice for a project through a vendor invoice journal, which is shown in the next figure. Please note that the vendor invoice line and the project to which the expenses are posted to, are shown in the upper part of the next screen-print whereas all project specific information is included in the project tab shown in the lower part of the same screen-print.

As one might expect, after recording the invoice but before posting it, no costs can be identified at the project level. Please see the next figure.

Once the invoice is posted, the respective project expenses are recorded as actual project costs. This can be identified from the actual cost column of the cost control window shown in in the next screen-print.

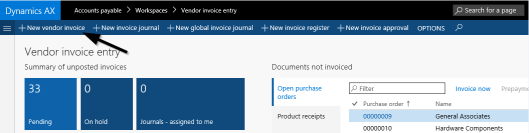

Let’s now have a look at what difference recording a similar invoice through the vendor invoice workbench – exemplified in the following screen-print – makes.

Except for the way how the expense invoice data are entered, the same information is recorded in the vendor invoice workbench shown below.

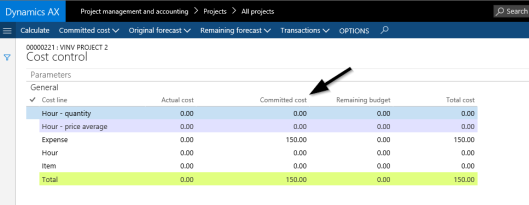

Yet, different from before, the project expense can already be identified at the project level, once the invoice has been recorded. For details, please see the project expense amount shown in the committed cost column of the cost control form that is illustrated in the next figure.

It is this ability of showing recorded project expenses early that differentiates the process of entering project related expense invoices through the vendor invoice workbench from recording them through vendor invoice journals. A knowledge of this difference is important especially in companies that see long invoice throughput times because an early identification of (forthcoming) project expenses can avoid wrong interpretations and subsequent actions.

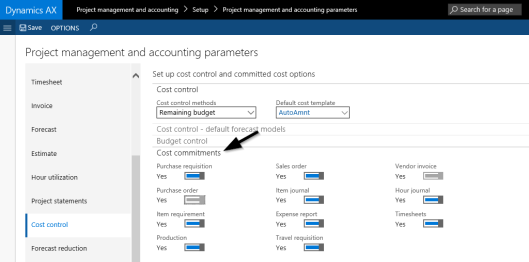

Note: A prerequisite for becoming able to identify project expenses early through the committed cost functionality is the activation of the corresponding project cost control parameters shown in the next screen-print.

In addition, a periodic batch job needs to be setup that identifies and illustrates the committed costs at the project level. Example:

Summary:

Using the committed cost functionality can be of vital importance for companies that face comparatively long invoice throughput times. Companies with short invoice throughput times do, on the other hand side, not considerably benefit from using the committed cost invoice feature that is only available for invoices recorded through the vendor invoice workbench. Expressed differently, companies, with short invoice throughput times have a greater flexibility when it comes to entering expense related project invoices.

Pingback: Vendor invoice recording (Part 1) | Dynamics AX Finance & Controlling

Is it the default functionality of Dynamics 365 or AX to show the Purchase order total cost in Committed cost when PO is confirmed?. My question is :- I have 25 % of prepayment on a Purchase order and I want that 25% to be displayed on Committed cost for a project. how do I do this? It would be really grateful if you could help me with this.

LikeLike

Hi, I would expect that this is not possible. Does it actually make sense trying to include a prepayment as a prospective (committed) costs? Prepayments are balance sheet transactions that are made at one time and deducted later on without affecting your costs. Best regards, Ludwig

LikeLike