This post deals with the foreign currency revaluation feature available in the Accounts Payable (AP) module and illustrates the effect that different parameter settings have on the foreign currency revaluation calculation and ledger posting. Please note that the examples and explanations made in the following do also apply for the Accounts Receivable (AR) module as the foreign currency revaluation functionality in AR is basically identical to the one in AP.

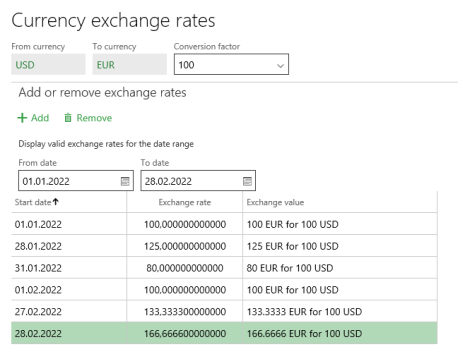

The examples below are all recorded in the Contoso DEMF company that uses the EURO as accounting currency. All sample vendor invoices are recorded in USD in January and February 2022. For those months/days, the following currency exchange rates apply:

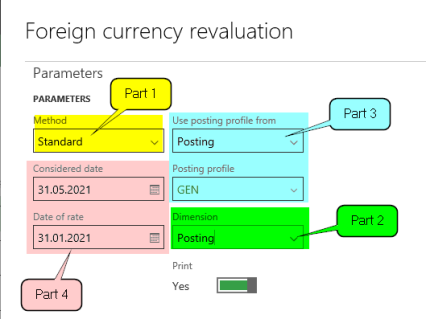

The post is separated into four parts. The first part starts with an analysis of the different currency revaluation methods. This part is followed by a subsection on the different financial dimension options available for foreign currency revaluation postings. Part 3 deals with the posting profile parameters and part 4 concludes this post by having a look at the different dates that can be selected when running the foreign currency revaluation process.

Part 1: Foreign currency revaluation method

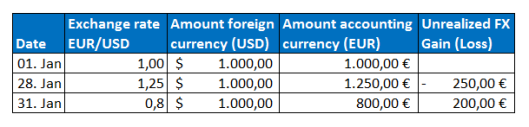

Let’s start by having a look at the different currency revaluation methods (standard, invoice date and minimum) that can be selected in the foreign currency revaluation parameters form. For that purpose a vendor invoice with a total amount of 1000 USD has been recorded on 1 January when the exchange rate between the USD and EUR stood at 1,00.

In order to illustrate the different foreign currency revaluation method options, three currency revaluations will be run on 28 .January and 31. January respectively, where the following currency exchange rates between the USD and EUR apply:

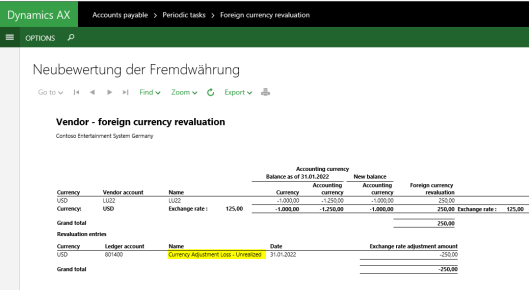

The first currency revaluation is run on 28 January with the “Standard” method.

Because of the appreciation of the USD, an unrealized foreign currency loss of 250 EUR arises that is shown in the following revaluation report.

The unrealized loss is posted on the account for unrealized currency losses and increases the vendor liability expressed in EUR currency correspondingly.

Next, a foreign currency revaluation with the „Invoice date” method is run.

Please note that selecting this method does not allow you changing the date value shown in the “Date of rate” field. As the “Considered date” value can be changed, I entered 31 January to identify the effect that this change might have on the transactions generated.

Result:

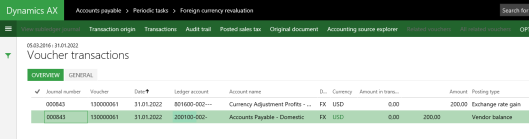

The revaluation report and the corresponding voucher show that the invoice method reverses the previous foreign currency revaluation. If you have a look at the voucher date then you can identify that the date value entered in the “considered date” field is used as the posting date for the foreign currency revaluation voucher.

The third foreign currency revaluation is run with the “Minimum” method. This time, the considered date and date of rate values are set to 31 January.

Result:

This time, Dynamics AX does not record any foreign currency revaluation adjustment and does not create a voucher. That is because the “Minimum” method does not record a foreign currency gain as it would result in an unrealized exchange rate profit that some countries – such as Germany – do not allow to report in corporate financial statements.

Part 2: Foreign currency revaluation dimensions

After having a look at the different method options available for foreign currency revaluations, the financial dimensions parameter is investigated next. To do that, let’s first have a look again at the invoice voucher that has been recorded on 1 January.

The invoice voucher illustrated in the previous screen-print shows that the vendor invoice is recorded with the financial dimension “Business Unit 002”.

Against the background of the invoice voucher generated, let’s have a look at the foreign currency revaluation voucher that is generated when “None” is selected in the dimensions parameter field.

If the foreign currency revaluation process is started with this parameter setup, Dynamics AX shows the following message:

If you confirm this message with Yes and run the foreign currency revaluation, a voucher similar to the one shown in the next screen-print results:

As one might expect, the foreign currency revaluation adjustment is recorded without any financial dimension value.

To identify what difference the selection of any other dimension parameter makes, the previous foreign currency revaluation is first reversed by using the invoice date method shown above and then run again by selecting “Posting” in the dimension parameter field. Please see the following screen-print for details.

Result:

This time, the foreign currency revaluation voucher is generated with the financial dimension that has been used for posting the vendor invoice.

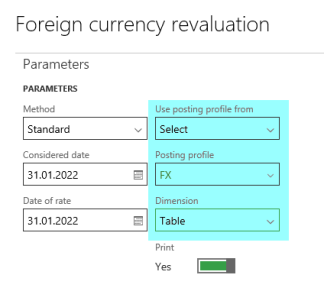

To see what difference the last dimension parameter (“Table”) makes, the previous foreign currency revaluation is cancelled again by using the invoice date method and run once again with the following settings:

Result:

This time, the foreign currency adjustment voucher is generated with the financial dimension “Business Unit 001”.

Please note that the financial dimension value “Business Unit 001” is taken from the vendor master record as exemplified in the next screen-print.

Part 3: Foreign currency revaluation posting profile

In this this part I want to focus on the difference that the selection of a specific posting profile makes to the foreign currency adjustment voucher. To do that, the previous foreign currency revaluation was first reversed by using the Invoice date method shown previously and then re-run with the following parameter settings:

Please note that the “FX” posting profile is setup with a different summary account.

Result:

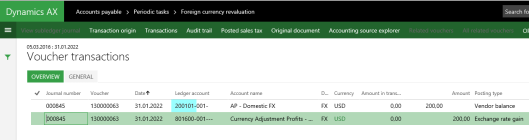

Different from what one would expect from the parameter settings shown above, the foreign currency adjustment voucher still uses the same vendor summary account (No. 200100) for recording the unrealized foreign currency gain. Please see the next screen-print.

The underlying reason for this behavior is that the dimension setting “Posting” overwrites the posting profile parameter setting.

In order to verify this system behavior, the previous foreign currency revaluation is reversed (by using the Invoice date method) and re-run with “Table” selected in the financial dimensions field.

Result:

This time, the unrealized foreign currency revaluation gain is recorded on the summary account that has been specified in the “FX” posting profile.

Note:

Using a separate posting profile for recording unrealized foreign currency profits can help companies in two ways.

First, through an easy identification of a company’s foreign currency exposure and the related risks. That is, while the unrealized foreign currency gain/loss accounts do not differentiate between group internal and external currency risks, the use of a separate posting profile with vendor/customer group specific summary accounts for foreign currency adjustments, can help companies assessing whether or not the use of foreign currency hedging instruments might be beneficial. The consideration behind this statement is that only risks from external currency fluctuations should be hedged while group internal currency risks do not require costly hedging instruments.

Second, the separation of currency revaluation effects on separate ledger accounts can alleviate the financial consolidation process.

Part 4: Foreign currency revaluation dates

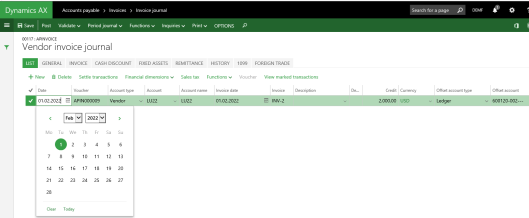

After reversing the previous foreign currency revaluation once again, a second vendor invoice for 2000 USD is recorded on 1st February. On this date, the USD/EUR exchange rate stood at 1,00. For details, please see the next screen-prints.

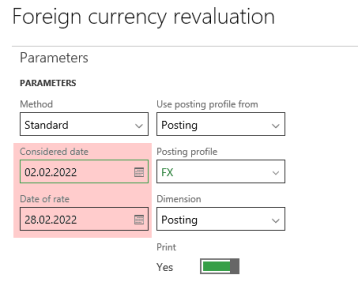

With the two vendor invoices posted in Dynamics AX, a first foreign currency revaluation was run with the following setting:

Result:

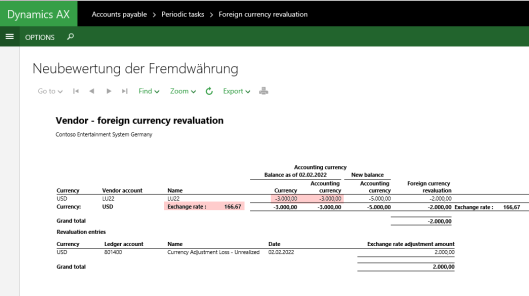

Dynamics AX generates a foreign currency adjustment based on the exchange rate valid on 28 February (0,6 EUR/USD or 1,6667 USD/EUR). Because the considered date (31 January) is before the date the second vendor invoice was posted (1 February), only the unrealized foreign exchange rate gain for the first invoice is taken into consideration.

After reversing the previous foreign currency revaluation, the revaluation process is re-run with a considered date value that is after the date on which the second vendor invoice was recorded.

Result:

This time, both invoices are included in the foreign currency revaluation process for recording the unrealized foreign exchange rate gain.

[Invoice 1: 1000 USD, Invoice 2: 2000 USD => Total: 3000 USD * Exchange rate as of 28 February (1,6667 USD/EUR) = 5000 EUR => 2000 EUR unrealized foreign currency exchange rate loss]

Hope you found some useful information in this post. Till next time.

Good Post Ludwig .

if possible please explain the GL foreign currency revaluation batch job also as it is linked with Bank account .

Please explain how make the balance adjustments between bank ( link with foreign currency) and GL ( Company currency ).

Many people requesting the same functionality in MS dynamics forums also.

Thanks in advance.

LikeLike

Hello lally,

Unfortunately standard Dynamics AX does not include a GL foreign currency revaluation batch job in the bank module for each and every country. For some countries in Eastern Europe such a GL-Bank foreign currency revaluation batch job is available and you can make it available also for other countries if required. I once described it here: https://dynamicsax-fico.com/2015/04/12/foreign-currency-revaluation-cash-and-bank-management-module/ Probably have a look at this earlier post to see if this helps you. All the best,

Ludwig

LikeLike

Hello Ludwing,

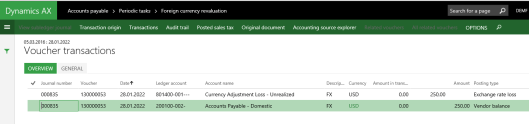

According to your example, can you explained why the voucher of the exchange rate shows the column “Amount in transaction currency” with zero amounts but in amount column we have amounts?

Thanks

Kindly regards.

LikeLike

Hi, The transaction was entered in USD in the contoso DEMF company that has the EUR as accounting currency setup.

Recording a foreign currency revaluation does not change your payable in foreign currency terms.

The only thing that is affected is your ‘home’ (accounting) currency payable.

Stated differently, the foreign currency revaluation does make make me richer or poorer in USD terms because my USD payable is still the same.

As the transaction was recorded in the transaction currency USD, the foreign currency revaluation voucher shows 0.00.

Hope this clarifies things.

Best regards,

Ludwig

LikeLike