After having analyzed how to deal with purchase price variances in order to arrive at a second (parallel) inventory value, let’s have a look at the second standard cost variance type – the inventory cost revaluation – and how to deal with those variances to obtain a second (parallel) inventory value for standard cost items.

Scenario:

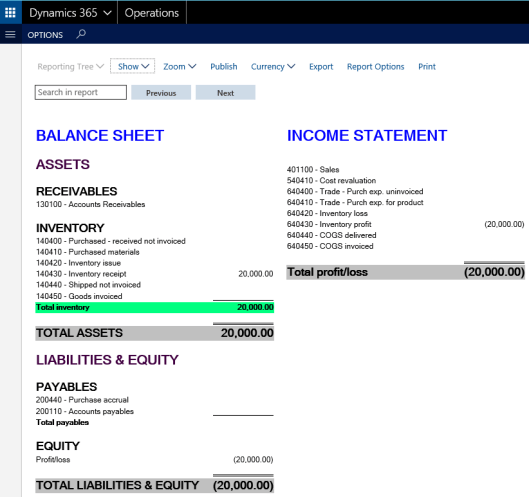

At the end of a fiscal year, the standard costs of a first item are adjusted from $100 to $109. For a second standard cost item, the standard costs are adjusted from $100 to $95. As there are currently 100 pcs from each of the items on stock, a total inventory value of $20000 can be identified (before adjusting the standard cost prices) in the financial statements illustrated in the next figure.

![]() For reasons of simplicity the inventory values/balances have been created by posting an inventory adjustment journal that resulted in an inventory receipt & profit transaction.

For reasons of simplicity the inventory values/balances have been created by posting an inventory adjustment journal that resulted in an inventory receipt & profit transaction.

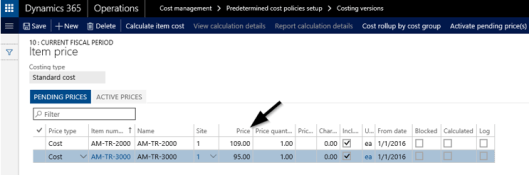

The aforementioned revaluation of the standard cost item is realized by recording and activating the new standard cost prices in the standard cost costing version, as exemplified in the next screen print.

Once the new standard cost prices are activated, the financial statements show a $400 higher inventory value. This can be identified from the next figure.

The overall increase in the inventory value can be explained by the value increase of the first standard cost item [($109-$100) x 100 pcs] and the value decrease of the second standard cost item [($95-$100) x 100 pcs]. If the revalued items will be sold subsequently, the newly activated standard cost prices will be used for posting the issue transactions.

At this point the question arises whether the inventory cost revaluation amount can remain in the income statement as illustrated in the previous screen print or whether an adjustment similar to the one that has been shown in the first part for the purchase price variance (PPV) is required in order to get a second (parallel) inventory value?

This question can be answered by stating that no split and allocation of the cost revaluation is required, if the cost revaluation is done in a way to adjust the standard cost prices to an ‘actual’ market price. If this is the case, any previously recorded adjustment and allocation of the PPV needs to be reversed in order to avoid an over-adjustment of inventory values towards actual market prices/values.

In practice, most companies do not adjust their standard cost prices in a way to reflect ‘actual’ (market) cost prices. Otherwise, they would have chosen an alternative actual cost price valuation model right from the beginning. Against the background of this common adjustment behavior, it can be argued that an adjustment of the recorded standard cost revaluation amount is necessary in order to arrive at an approximated actual inventory cost price. The main question in this context is then how such an adjustment can be realized?

From the authors’ perspective, the complete cost revaluation amount needs to be shifted (allocated) from the income statement to the balance sheet in order to arrive at an actual cost valuation amount. That is because only those items that are currently on stock (or in process) – that is receipt transactions – are affected by the cost change variance. If those items are sold or consumed later on the adjusted higher/lower standard cost price will ensure that the cost revaluation amount that has been allocated to the balance sheet is successively eliminated. For that reason no split up and allocation of the cost revaluation amount is necessary.

The next part of this series continues with analyzing cost change variances and how they need to be incorporated into this parallel inventory valuation approach.