Some time ago I came across the following blog post that illustrates the effect of using the effective labor rate for project hour transactions.

While the post nicely describes the effect of activating the parameter I was still not sure whether – from a finance & controlling perspective – the use of the effective labor rate makes sense or not.

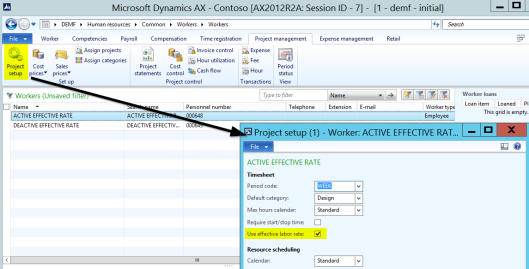

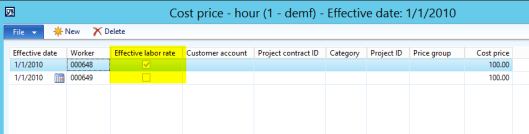

To analyze this in more detail, I setup two test workers; one with the effective labor rate activated and one without the effective labor rate activated.

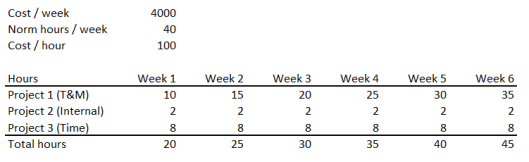

Similar to the example illustrated in the aforementioned blog post of Sandeep, I used a cost price of 100 for each of the workers and setup a “norm” working time of 40 hours / week.

In order to identify the difference in the project costs of my workers, I recorded the following hour transactions on a time and material project (“T&M”), an internal project (“Internal”) and a time project (“Time”):

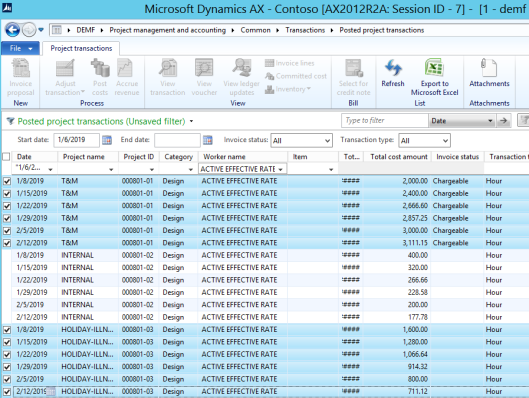

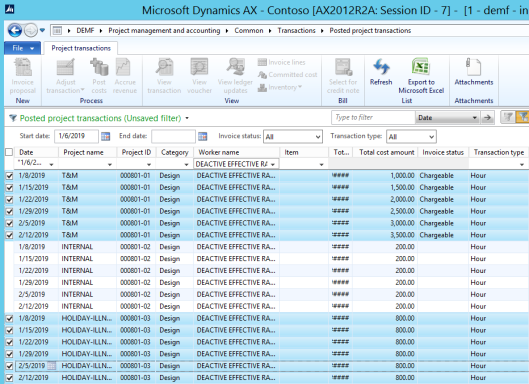

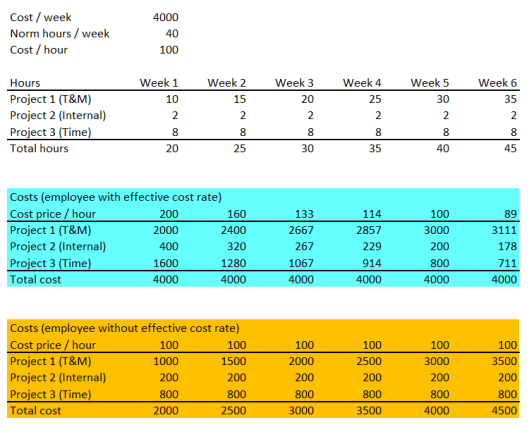

After all hours have been posted, I was able to identify the following cost Transaction amounts for my workers.

The next screen-print summarizes the results of my hour postings:

What you can identify from the previous screen-print is that the worker with the effective labor rate activated always causes project costs of 4000 irrespective of the actual time worked on the different projects.

On the other hand, the total project costs of the worker without the effective labor rate activated fluctuate and depend on the actual hours worked on the different projects.

Based on this outcome one can summarize that the usage of the effective labor rate functionality probably works best in companies where employees record all their working time on projects and where projects establish the fundamental core element of the company’s finance & controlling system.

Companies that scarcely use projects or only use them to track and analyze special costs are probably better off not using the effective labor rate functionality as too much costs might be allocated to projects.

A second aspect of using or not using the effective labor rate functionality is related to a company’s profit and loss statement (P&L).

Provided that a company’s salary / wage expenses and the project payroll allocation account are included in the administrative expense section of the P&L but the project related costs in the cost of sales section of the P&L, activating the effective labor rate feature can have an influence on a company’s KPIs (key performance indicators) such as the gross profit rate. The next screen-print summarizes this effect for the transactions recorded above.

(Note: In the illustration shown above I assume that all hour transactions are recorded on ledger accounts. This is not the case for time projects but does not change anything on the general outcome and interpretation).

In other words, the effective labor rate functionality provides finance managers with a “window dressing” instrument that allows them influencing KPIs. For that reason, using the effective labor rate feature needs to be analyzed and discussed thoroughly with the operative management team as KPIs are often linked to bonus and other payment elements of managers.