Tags

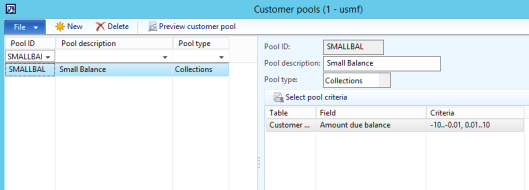

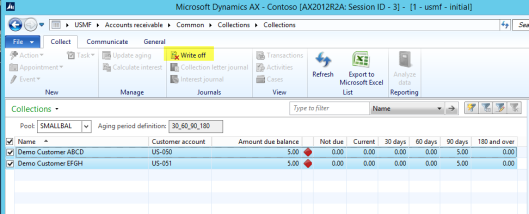

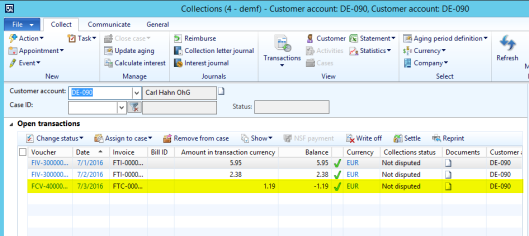

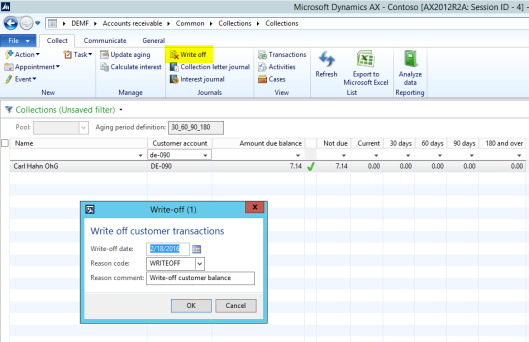

In one of the prior posts I showed you how customer pools can be used for identifying and writing-off small customer balances. (Please see the following two screenshots).

Problem

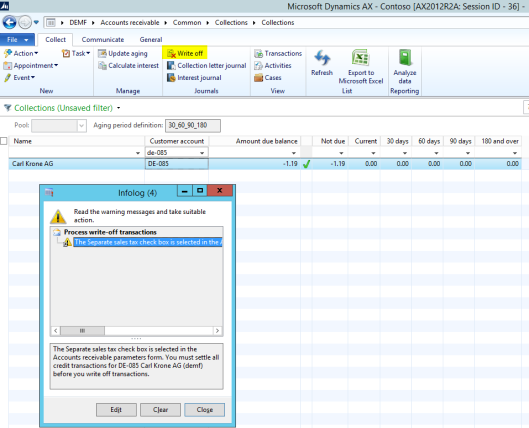

If you are trying to write-off a customer with a negative balance you might receive the following error message that interrupts the write-off process.

The underlying reason for this error is the following Accounts Receivable parameter which ensures a corresponding tax correction posting for the transactions that are written off.

Note that the error message does not pop up if the “separate sales tax” parameter is not activated. Deactivating this parameter is, however, not an option unless you want to pay more tax than necessary and generate wrong sales tax postings.

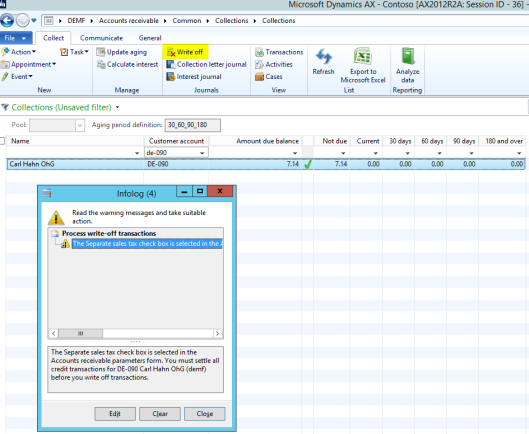

Please note that you might also encounter the error message shown above in situations where everything seems on first sight ok. Example:

In those cases the underlying reason for the error are usually credit transactions that are included in the total (overall positive) customer balance.

Solution 1

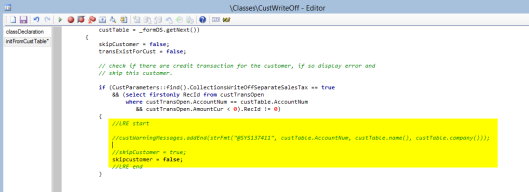

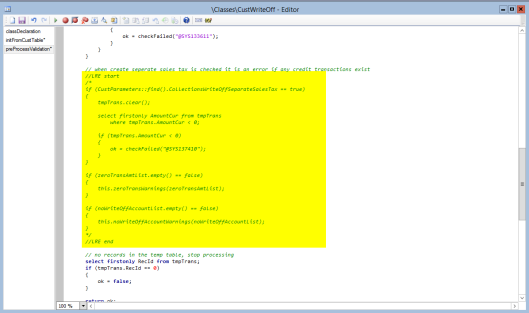

A first option to get the issue fixed is making the following code adjustments in the CustWriteOff class.

Result: Once the code adjustment is implemented, the negative customer balance can be written off.

Please note that Dynamics AX generates the write off transactions including the corresponding tax correction as exemplified in the next screen-print.

Also the small customer balance that includes a credit transaction can be written off.

Please note that Dynamics AX summarizes the different transactions included in the total balance and generates the corresponding tax adjustment transactions. If different tax rates have been used for posting the original transactions, several tax adjustment lines will be created.

Solution 2

If your management does not like to implement a code adjustment and/or if you are working with older Dynamics AX versions that do not have the collection functionalities available, you can alternatively follow the next steps to write off small customer transactions.

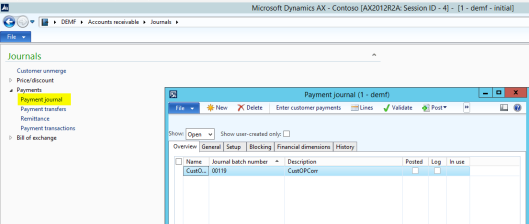

Step 1: Create a new customer payment journal

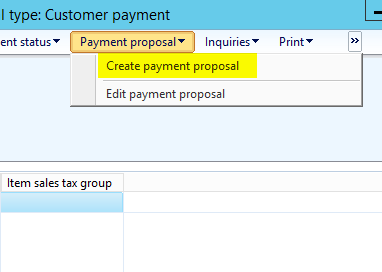

Step 2: Create a payment proposal

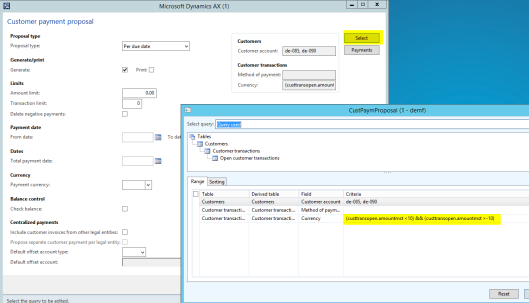

Step 3: Select the transactions that need to be written off

Note: Selecting a range of small transaction amounts requires specifying a SQL statement similar to the one exemplified in the previous screen-print. For additional details, please see e.g. this site.

The second approach illustrated here does not refer to small customer balances but instead to individual customer transactions that fall within the $-amount range specified in the SQL statement.

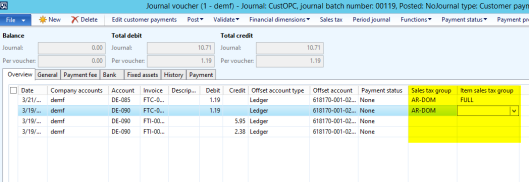

Step 4: Change method of payment

To ensure that the small customer transactions are posted against the correct ledger account, it is wise setting up a new method of payment that is linked to a “depreciation account”; in my example main account no. 618170. Once this method has been setup, all customer transactions that shall be cleansed need to be changed to this method.

Step 5: Select the correct sales tax group/item sales tax group

The last step before posting the journal requires ensuring that the correct sales tax groups and item sales tax groups are selected. Otherwise no tax correction will be posted.

Hi Ludwig thanks for the post, is there any possibility that when you write off the invoice a vat amount will be written off on another VAT account instead of the one registered on actual invoice.

LikeLike

Hi, To my knowledge this is not possible in the standard application. Why do you want to make use of a different main account for posting the VAT correction?

LikeLike

Thanks ! This is one of the requirement where VAT will be registered in X account and when write off it will be Y account. Can something be achievable through customisation and how much customisation will be required. However it will reconcile the vat account ?

LikeLike

Hi, The ledger account is related to the sales tax code through the ledger posting group. You would have to modify AX in a way that a different sales tax ‘correction’ code that has a different ledger account setup is used at the time you write off the transaction. The tax correction code can be setup the same way as your ordinary one but have a different ledger account setup. Then you should be fine with the reconciliation. Before making this modification, as usual, please test throughly. Best regards, Ludwig

LikeLike